I. Introduction

Copious legal and economic scholarships have devoted to trademarks and their role in protecting the consumer from the likelihood of confusion and enhancing the efficiency of the marketplace through fair competition. This Article focuses on trademarks from a different angle: whether trademarks are indeed valuable enough so that trademark owners can rely on them in seeking a loan or obtaining capital. In other words, when a company seeks a loan or obtains capital, do lenders and investors share the trademark owner’s view that trademarks are important property assets worthy to serve as collateral? Before getting to the question, let’s take a look at the market bombardment with messages about trademarks, brands and all-things-trademarks.

Brand Finance released its latest ranking of the most valuable brands in 2018.[1] Amazon tops the chart with a staggering valuation at $150.9 billion, Apple takes second place at $146.3 billion, Google comes next at $120.9 billion, and then the remainder of the 500 lists of trademarks known in various sectors follows in descending order.[2] U.S. companies registered more than 300,000 trademark classes domestically and more than one million internationally in 2016.[3] When Chipotle confirmed that it filed a trademark application for “Better Burger,” its stock shot up 2.5 percent in after-hours trading.[4] The parent company of Keva Juice and Garduno’s plans to pay a $2.5 million bid for “Flying Star” in a bankruptcy proceeding.[5] More than 10,000 trademark lawyers attend the annual International Trademark Association meeting to discuss all things relating to trademarks.[6] All seem to confirm that trademarks are valuable corporate assets. Moreover, as far back as 1875, trademarks were used in chattel mortgage for a loan.[7]

Since trademarks are valuable corporate assets the assumption naturally goes that lenders in modern time would readily accept them as collateral in financing, and particularly, secured financing.[8] Lenders would extend a credit line or make term loans against trademarks just as they would have against other corporate assets.[9] Moreover, lenders all know that secured transactions law provides a comprehensive framework to encourage secured financing with the use of all types of corporate assets, including trademarks, as collateral.[10] Essentially, there is no impediment to leverage and accept trademarks as collateral in financing.[11] The puzzle, as this Article identifies, is that lenders, especially banks, don’t dare to lend against trademarks in asset-based lending. In fact, most trademarks are idle assets, as both banks and nonbanks typically don’t accept trademarks as collateral.[12] Only 10% of registered trademarks serve as collateral per United States Patent and Trademark Office (USPTO) filing data.[13]

This Article is the first to conduct an empirical study on financing with trademark collateral by banks and nonbanks. We examine filings of trademark collateral in the USPTO from 2002 to 2015, with 2015’s data being the most recent data available. Drawing on our larger inquiry on Intellectual Property Venture Banking,[14] we compare patent collateral to trademark collateral and provide insights into lenders’ treatment of different types of intellectual property assets. In addition, our closer examination reveals possible explanations for lenders’ trademark collateral aversion that are rooted in the byproduct of trademarks.

The Article proceeds as follows: Part II briefly catalogs various evidence of trademarks as valuable assets to business, setting the framework to raise the inevitable question of whether banks and nonbanks would accept trademarks as collateral. Part III determines how to search for trademark collateral by understanding how lenders would protect their risks under Article 9 of the Uniform Commercial Code (UCC-9) if they accept trademarks as collateral. Though courts have held that UCC-9 governs perfection of security interest in trademarks, lenders have typically gone beyond and filed their security interests with the USPTO.

Part IV focuses on the USPTO database for trademark collateral. We conducted searches in the trademark assignments that are inclusive of security interests. We obtained a set of data from the USPTO and separated the data into banks and nonbanks for analysis. As loans from banks are cheaper to obtain compared to nonbanks, the first set of Tables provides historical information from 2002 to 2015 of lending by banks and nonbanks with trademarks as collateral.

Coding the data into different tables and figures, Part V provides a closer examination of lending with trademark collateral. Here, we provide possible explanations for lenders’ aversion to trademark collateral. The aversion is not only for trademarks but patents. Also, lending based on future income or accounts receivable from trademarks may contribute to small trademark collateral filings.

The Article concludes that additional inquiry in the area of trademark financing will provide a comprehensive understanding of the trademark role in business.

II. The Valuable Trademarks?

There is simply no shortage of evidence that trademarks are valuable and important to businesses. CEOs of companies are readily defending their corporate name and image. Mark Zuckerberg had to endure days of preparation by handlers for charm offensive before testifying in Congress,[15] and then days of apologizing, deflecting, and defending Facebook tactics in front of lawmakers from different committees[16] to make sure that the brand would stay intact after the privacy scandal.[17] Tim Cook seized the moment to reaffirm Apple’s pristine image in contrast to Facebook’s behavior of monetizing users’ privacy as products.[18] Kevin Johnson immediately addressed the controversy over the arrest of two black patrons in Starbucks’ Philadelphia store by employing a sweeping and unusual action of closing more than 8,000 stores for all employees to attend racial-bias training, striving to maintain the “inclusivity” image of the Starbucks brand.[19]

Trademarks are not random words or symbols; they are the embodiment of the company’s product and culture.[20] In monetary terms, the embodiment is expressed in the valuation, often in billions of dollars, assigned to top brands in various sectors.[21] Marketers issue annual lists of brands and their associated valuations,[22] commanding attention from all.[23]

Businesses often pay extra care to the visibility of their trademarks in the marketplace.[24] Some would devote resources to ascertain whether their trademarks are recognized in a particular niche through a brand awareness consumer survey.[25] Many embark on strategic campaigns to identify and implement different strategies and methods to enhance trademark visibility.[26] All know that no trademark presence in the marketplace may mean no product, no service, and no corporate existence in a near future.[27]

In addition to marketing efforts for trademark enhancements, trademarks are important to tax strategies.[28] Indeed, many multistate companies maximize returns from their trademarks through tax avoidance schemes.[29] Through assignment and license back schemes, owners of many trademarks avoid paying state taxes on royalty income stemming from the licensing of trademarks between affiliated companies.[30] Companies including Victoria’s Secret, Nordstrom, and Sherwin-Williams have turned their trademark assets into effective tax tools to boost the corporation’s overall value.[31]

Assisting business in leveraging, protecting, and enforcing trademarks is an army of trademark practitioners.[32] Trademark practitioners can provide plenty of evidence of valuable trademarks to private and public organizations through dockets of litigation involving trademark ownership, infringement, false advertisement, and unfair competition claims.[33] Business use litigation to protect and enforce their trademark rights.[34] Without enforcement, the trademark’s associated goodwill may soon lessen in value in the marketplace due to unauthorized use by others.[35] Worse, the trademarks may fail to distinguish the client’s products from others’ goods.[36]

Also, trademark practitioners can rely on the annual increase in the number of trademark registrations granted by the USPTO as evidence of a trademark’s value and importance.[37] The high volume of trademark registrations explains that businesses need trademarks in daily operation and existence.[38] They are willing to pay registration fees for each class of goods and services and submit necessary samples to secure the registrations.[39]

In academic circles, scholars have elevated the importance of trademarks by devoting substantial time to numerous studies and publishing voluminous treatises, books, and law review articles on trademarks.[40] Some may even argue that trademarks are perhaps more valuable than other types of intellectual property in some cases.[41] Given the existing copious scholarship on trademarks and the continuous litigation involving trademarks, we do not anticipate that the scholarship will slow down in the foreseeable future.

Overall, all evidence suggests that trademarks are valuable corporate assets. If they are, have lenders been willing to provide financing against trademarks?

III. The Search Scope for Trademark Collateral and UCC Article 9

Trademarks have an illustrious history of serving as collateral in financing deals for business.[42] A company in need of financing as far back as in the area of chattel mortgage could include trademarks in the mortgage grant for a loan.[43] Then, if the company failed to repay the loan or meet its obligations under the mortgage agreement, the mortgagee would employ an agent to succeed to the mortgagor’s business; it was the only way to foreclose on the trademark collateral.[44] Much has changed in the financing landscape where trademarks are part of the collateral.[45] One thing that does not change, however, is creditors wanting to reduce their risks.[46]

Turning to the legal system for risk reduction, creditors rely on Article 9 of the Uniform Commercial Code.[47] That means the creditors take security interests in the trademark collateral and follow optimal methods of perfection in ensuring priority over other creditors, including bankruptcy trustees.[48]

A detour for a brief discussion on Article 9 and perfection of a security interest is necessary here. Article 9 governs all transactions that create security interests in personal property by contract.[49] The personal property a debtor owns or has rights to may include inventory, farm products, equipment, instruments, documents, investment property, deposit account, letter of credit, accounts, chattel paper, payment intangibles, promissory notes, and general intangibles, among others.[50] For evidentiary and enforcement purposes, the debtor and secured party typically execute a security agreement along with a credit or loan agreement.[51] While the parties can rely on the terms of the security agreement as a matter of contract, the public is not on notice that the secured party has encumbered the debtor’s personal property.[52] In the event that the debtor has subsequently used the same property as security for another loan, neither the second secured party knew the existence of the prior transaction nor the first secured party had knowledge of debtor’s dealing. To encourage secured transactions in both scenarios and many others, Article 9 devises a perfection system and a set of priority rules. Filing the financing statement is one of the methods of perfection and is most common.[53] A secured creditor who files or perfects its security interest first will enjoy priority over others who come later in time.[54]

With respect to trademark as personal property, Article 9 lumps all types of intellectual property assets into the catch-all category of “general intangible.”[55] Under Article 9, the perfection of a security interest in a general intangible requires the filing of a financing statement.[56] Article 9 dictates that the state law on secured transactions does not apply to the extent that a federal statute, regulation, or treaty preempts.[57] With respect to trademarks, there is no specific federal statute preempting the registration of security interest in trademark collateral.[58] That means the perfection of trademark collateral is within the legal framework of Article 9.[59] The creditors as the secured party will, therefore, file a UCC-1 financing statement to perfect their security interests in most types of personal property, including trademarks.[60]

Consequently, the scope of the search for trademark collateral will be confined to the Secretary of State Office where the debtor is located.[61] That is easier said than done. Under secured transactions law, the UCC-1 filing only needs a very generic phrase to indicate the overall collateral because the purpose of the filing is to merely serve as a notice to the public.[62] The purpose of notice filing is not to educate the public of the specific collateral the debtor is granting in the security interest to the secured party.[63] The notice filing is a blessing and a curse. On the one hand, the super-generic UCC-1 statement reduces the burden on the secured party, enabling business to gain access to credit and facilitating more secured transactions to occur.[64] On the other hand, there is nothing much the public can glean from a statement like “all debtor’s general intangibles” to ascertain specific trademarks that the debtor is using as collateral in the secured transaction.[65]

Directly in contradiction with the lower court decisions that only state UCC filing will perfect a security interest in trademarks, secured creditors have for years filed their security interests in trademarks with the U.S. Trademark Office.[66] Trademarks are a peculiar type of personal property with protection under both the federal and state systems.[67] With the major revision of trademark law in 1946 to expand the national scope of trademark protection, many businesses today seek federal trademark registrations to benefit from the broad protection.[68] But trademarks can receive federal protection without being registered by the U.S. Trademark Office.[69] In addition, trademarks can enjoy protection under state law, though the scope of protection is narrow.[70] The dual protection systems available to trademarks may cause the secured party some discomfort in deciding where to file its security interests in the trademark collateral.[71] Further, there are very few court decisions relating to perfection of security interest in trademarks.[72] As a result, creditors often file both the UCC-1 financing statement with the Secretary of State and the security interest filings with the U.S. Trademark Office,[73] as their belts and suspenders to reduce the risk of having unperfected security interests in trademark collateral.[74]

Accordingly, we will look to the U.S. Trademark Office for the filing data on trademark collateral. We are, however, mindful that some creditors may opt for filing only the UCC-1 financing statements with the Secretary of State Office to perfect their security interests in trademark collateral.[75]

IV. Lending, Searches and Trademark Aversion

A. The Lenders: Banks and Nonbanks

A company’s trademarks or brands can attract financing sources. The company may seek investors to exchange capital for equity in the business, but that may not be palatable because the company may not want new shareholders to dictate and control the company’s business direction.[76] Instead of equity financing, the company turns to debt financing. In debt financing, the company, of course, desires lower cost for the loan.[77] Two sources for debt are banks and nonbank financial institutions.[78]

Loans from banks are typically cheaper than from nonbanks because bank money is from deposits and banks can borrow from the federal funds.[79] About deposits, bank money is not the bank’s own money but other people’s money.[80] Deposits provide banks with a large pool of capital, and banks don’t pay much interest on deposits while charging higher rates for loans and making money from other banking services.[81] In addition, the bank has immediate access to federal funds through the interbanking system when the bank is temporarily in need of cash at the end of the business day while other banks have a surplus to lend overnight.[82] The overnight rate in most countries is set by the central bank, and the rate is typically the lowest available interest rate.[83]

Overall, banks have a lower cost of funds while nonbanks obtain their funds from investors.[84] Banks can charge lower interest rates on loans; nonbanks charge higher for the same amount.[85] But banks are heavily regulated and, due to banking regulations, [86] are reluctant to make loans and often impose stringent borrowing requirements.[87]

A company with traditional assets like inventory, equipment, and accounts receivables can seek loans from banks through assets-based lending (ABL).[88] The loans are “revolving credit lines or term loans that are secured by the borrower’s assets.”[89] Depending on the quality and value of the assets for collateral, the bank determines the availability of the credit to the borrower.[90] That means ABL from banks is typically available to midsized and large corporations with traditional assets.[91] Given trademarks are valuable corporate assets, do banks and nonbanks accept trademarks as collateral in determining the credit available to borrowers? If they do, banks, as cautious lenders, would most likely file their security interests in trademarks with both the Secretary of State Office and the USPTO.

B. Trademark Security Interest, Assignment, and USPTO Data

The USPTO maintains a database for all recorded trademark assignments from 1955 to the present.[92] We began at the USPTO’s “Assignments on the Web” page to conduct our searches. A searcher must provide information in the query boxes to conduct a search.[93] There is no query box for “security interest.” Though the term “assignments” means the transfer of ownership, the USPTO includes security interests in the database. There is no separation of “assignments” for ownership and security interests in trademarks. That means we were not able to screen out “security interest” from the “assignments.”

We then applied the search term “bank” in the “Assignee” query box and saw a return of “Page 1 to 7279” and a “Total 181967.”[94] An “assignor” denotes the borrower or grantor of a security interest, and the “assignee” is the secured party. In an “assignment record,” all the trademark registrations that serve as collateral are included.[95] The actual security agreement accompanying the cover page “Trademark Assignment” is also available.[96] In the end, the “Assignments on the Web” for trademark searches is not suitable for our study. Also, it would be a Herculean task to manually comb through each trademark ever recorded as collateral mixed in with ownership assignment.

By not including “security interest” in the query search box, the USPTO seems to imply that trademark registrations that serve as collateral are neither necessary nor important. Perhaps technological incapability is a reason. Nevertheless, the USPTO does not hesitate in demanding fees for security interest recording for each trademark.[97]

We then contacted the USPTO to obtain a set of databases of all security interests in trademarks. We imported the data to Excel and separated the banks as a secured party from nonbanks as a secured party. There is a total of 1,322,509 trademark records in the data.[98]

In addition to the trademark data, we also analyzed patent collateral data for comparison purposes. We noted that at the USPTO’s website for patents, we could search for security interests in the “Conveyance Type” box query, although the inadequate and misleading explanation provided for that box states “the nature of the transfer of ownership of property from one person to another.”[99] A grant of a security interest is not a transfer of ownership.[100] We downloaded the patent data and cleaned it up for security interest conveyances.[101]

C. The Search Results—Trademarks as Idle Assets?

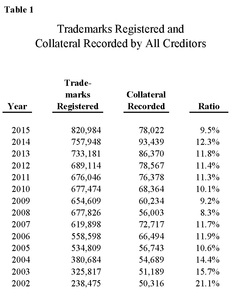

From 2002 to 2015, a total of 8,345,463 trademarks were registered by the USPTO.[102] Only 949,525 trademarks are collateral.[103] That means only 11% of trademarks are worthy to be utilized either as “boot collateral” or primary collateral for loans by all lenders. The remainder, 89%, are idle assets. We separated the data for each year and formulated the first table and figure set.

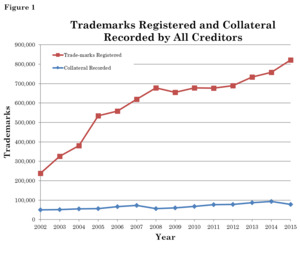

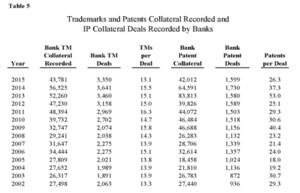

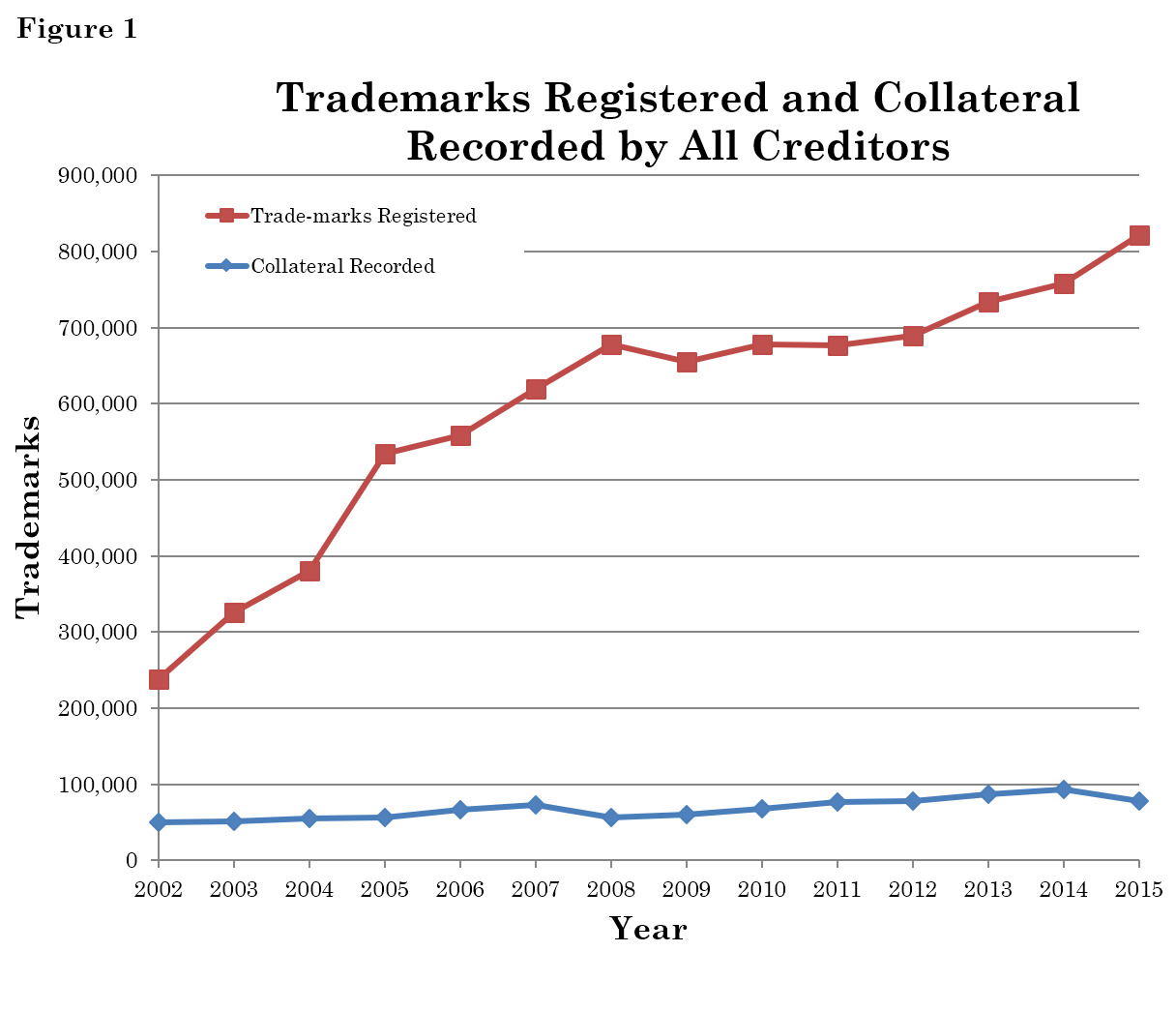

Table 1 shows the number of trademark registrations and collateral recorded, and the ratio from 2002 to 2015. Figure 1 provides a corresponding graph.

Consistent with the economic reality during the financial crisis in 2008–2009, the ratio of trademark collateral recorded sank to 8.3% in 2008 and 9.2% in 2009. After the finncial meltdown, the ratio of trademark collateral recorded has very slowly climbed back but failed to reach the high of 21.1% in 2002. In fact, the ratio of trademark collateral recorded in recent years is about half of the peak year of 2002. In the last five years, the ratio is at 11%. That means 89% of trademarks are not recorded by lenders as collateral with the USPTO. This finding is consistent with patents as collateral.[104] Lenders shun both trademarks and patents as collateral in financing.[105]

V. A Closer Look And Possible Explanations

A. Banks and Nonbanks in Trademark Collateral

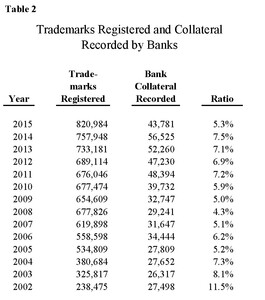

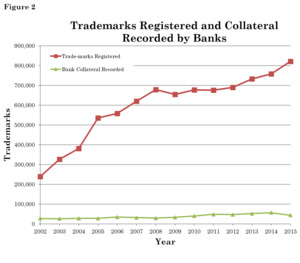

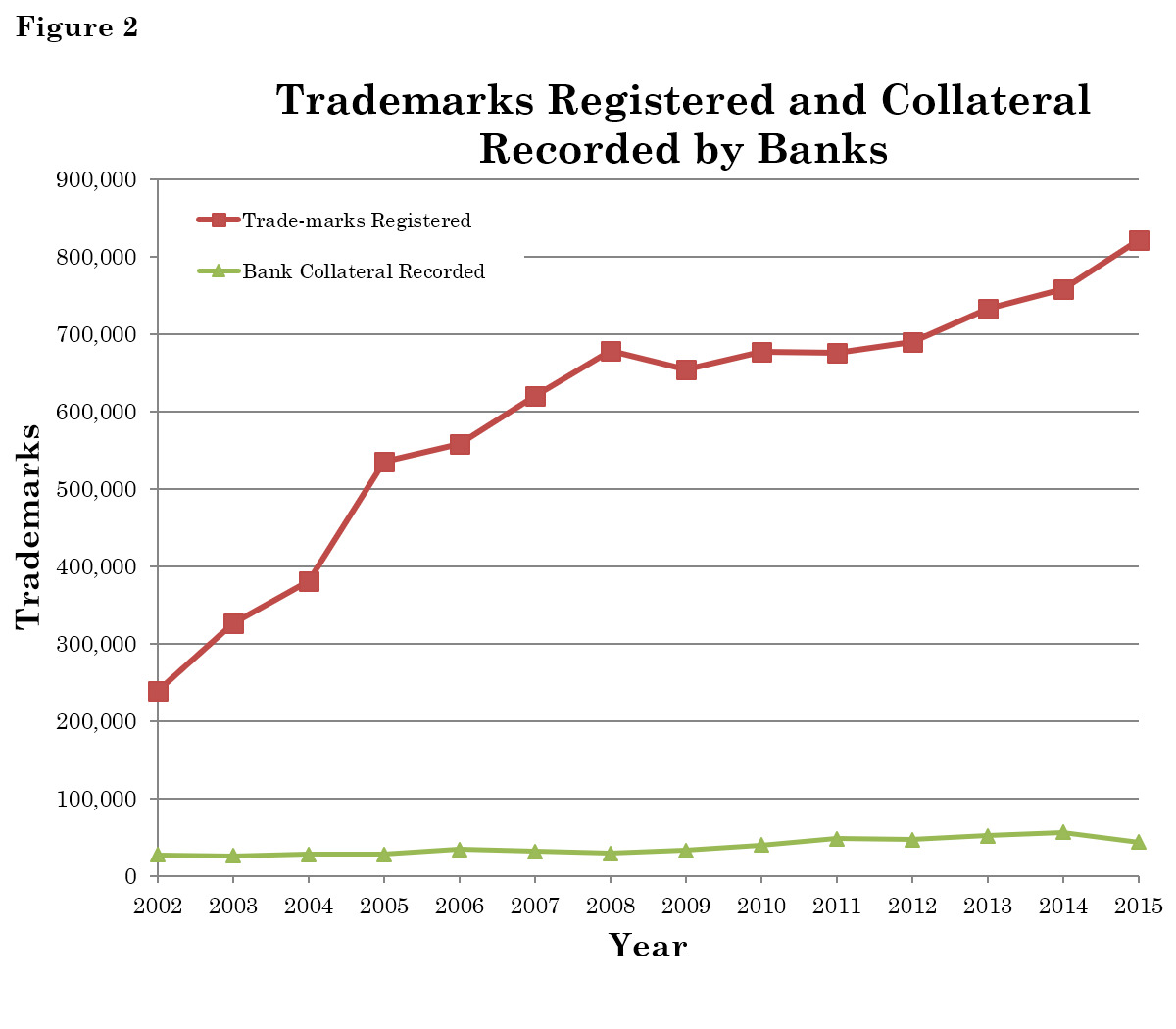

Table 2 and corresponding Figure 2 show the number of trademarks banks have recorded as collateral with the USPTO. In actual numbers, banks increased their acceptance of trademarks as collateral. For example, banks recorded 52,260 and 56,626 trademarks as collateral in 2013 and 2014, respectively. These numbers are higher than the 26,317 trademarks recorded by banks as collateral in 2003. Sheer numbers alone, however, fail to provide the full picture, because, in the ratio of the collateral recorded versus trademarks available, the ratio is only 7.1% and 7.5% for 2013 and 2014, respectively. These two ratio numbers are below 2003’s which was at 8.1% and substantially below 2002’s which was at 11.5%. Overall, in the 10-year period from 2006 to 2015, the ratio was 6% and in the five-year period from 2011 to 2015, the ratio was 6.7%.

Overall, the low ratio of trademarks recorded by banks as collateral is consistent with the reality that trademarks and other intellectual property assets are the nontraditional assets that banks often do not count as “assets” for collateral in determining the loans.[106] In other words, banks don’t value trademarks or patents, among other types of intellectual property.[107] From the banks’ perspectives, trademarks are “credit enhancers” or “boot collateral” included in a borrower’s overall assets as collateral but not the primary loan collateral.[108] Lenders from banks to nonbanks know that a loan against a trademark is seen as “the fulcrum security on a tough balance sheet.”[109] In other words, the borrowers in these situations are too risky for both banks and nonbanks. Banks would shy away from these borrowers while nonbanks may lend with very high interest rates and fees.

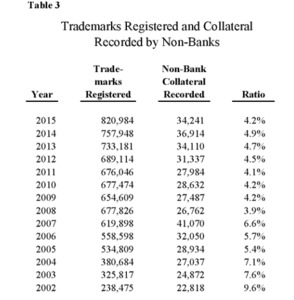

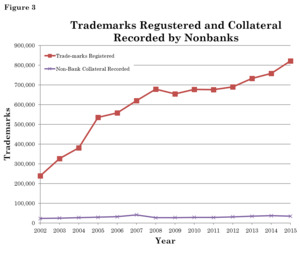

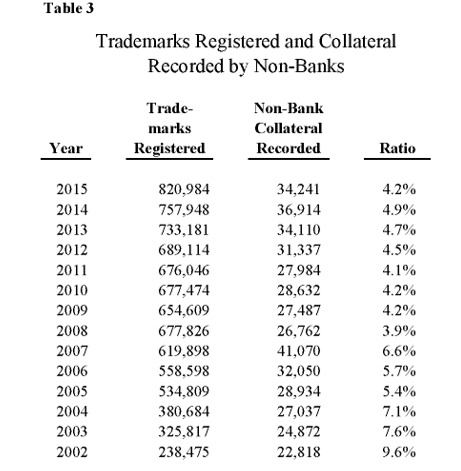

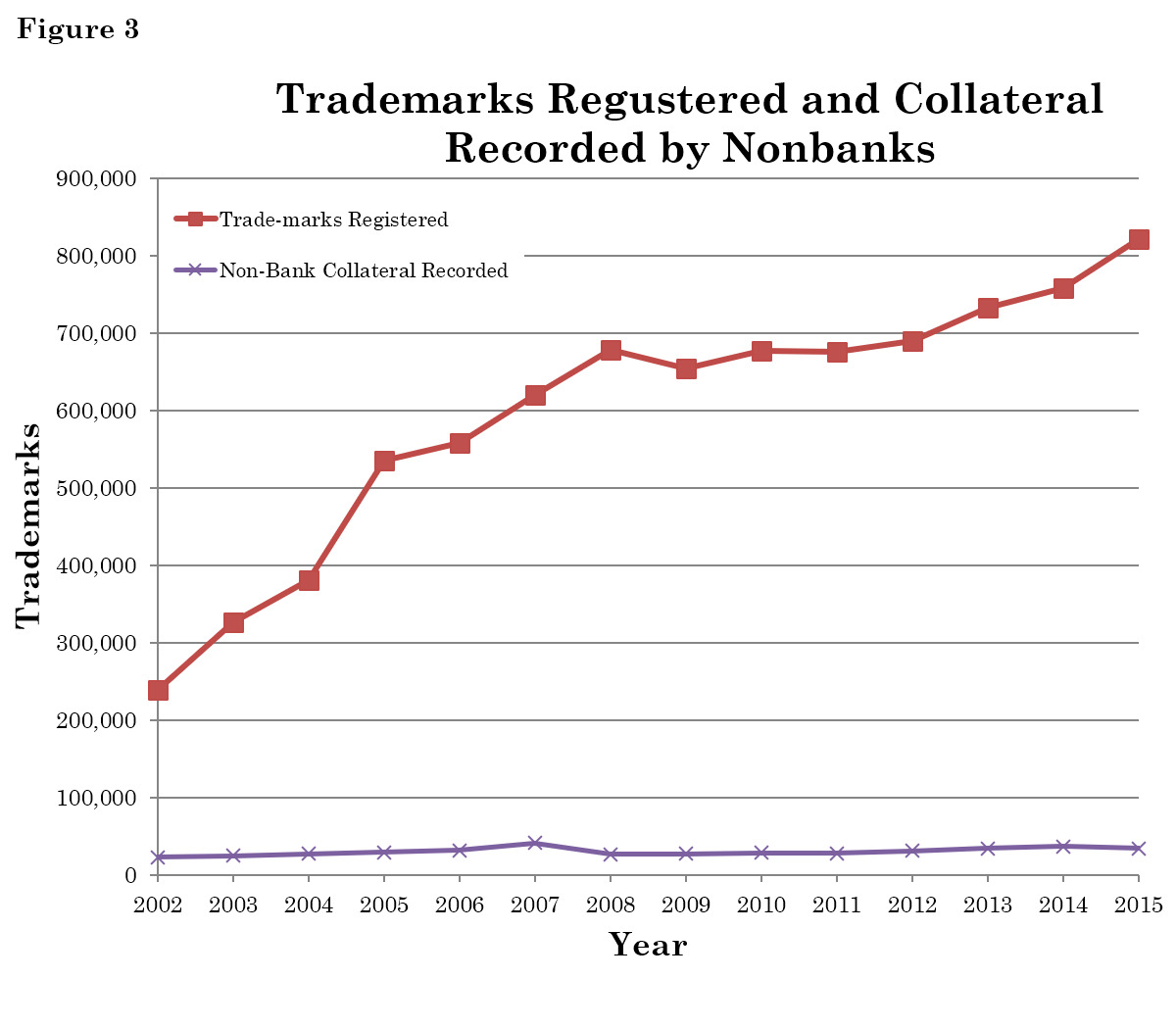

Table 3 and corresponding Figure 3 provide the number of trademarks as collateral recorded by nonbanks and the related ratio of the collateral recorded to the total trademark registrations each year from 2002 to 2015.

As Table 3 illustrates, nonbanks are active in the lending space with trademarks as collateral, taking about 4% of the total trademark collateral recorded. Nonbanks have been aggressively stepping into the niche that banks have avoided.[110] This trend is consistent with reports on the increase in nonbank lenders providing asset-based lending to companies.[111] With respect to “brand loans,” nonbank lenders have devised three common loan structures with trademarks as part of the collateral.[112]

ABL: the trademark or brand is part of the borrowing base, constituting a small percentage (in the form of an advance rate) of the net forced liquidation value.[113]

Stretch ABL: Appraisers will conduct a valuation of the trademark or brand. The brand becomes part of the first lien collateral package to entice lenders to “stretch to higher advance rates on working capital assets” due to the trademark/brand as “boot collateral.”[114]

Second Lien: In this transaction a nonbank lender provides a term loan with first lien on the trademark/brand collateral while the bank provides a credit line on the traditional assets as collateral with first lien.[115] Essentially, the borrower’s assets are bifurcated, and banks and nonbanks structure the two transactions for two different types of assets.[116]

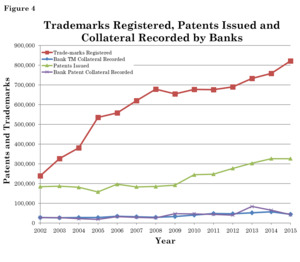

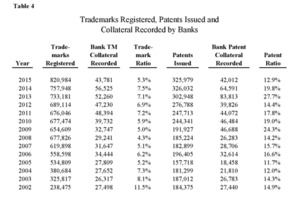

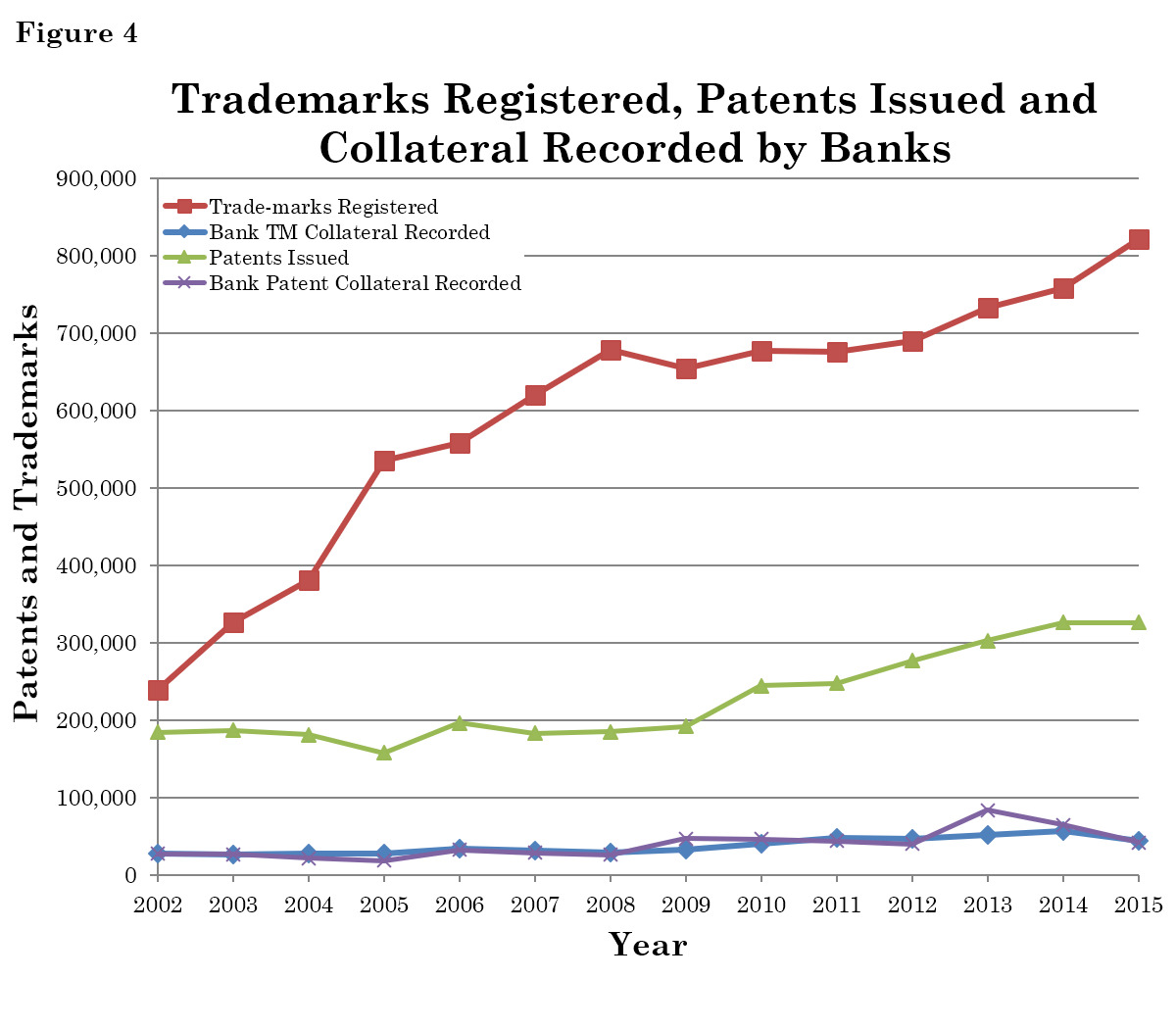

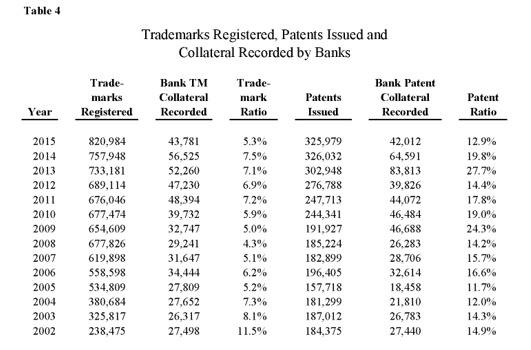

B. Trademark Collateral Versus Patent Collateral

Lenders seem to reject both trademarks and patents as collateral in secured financing as seen in the small percentage of patents and substantially smaller percentage of trademarks recorded as collateral compared to the total trademarks and patents available. For patents, from 2002 to 2015, only 17.2% of patents were recorded as collateral, and 82.8% of patents were not. For trademarks, 6.3% of trademarks were recorded as collateral and 93.7% were not, see Table 4 and Figure 4.[117]

A closer examination of banks that are willing to lend with patents as collateral reveals some important insights on lending and innovation. We have identified those insights in our study about outlier banks that specialize in lending to startups and high growth tech companies, and we name this type of lending business model “IP Venture Banking.”[118] The outlier banks charge zero or little interest on the loan, take a security interest in the patents, and require warrants to purchase shares in the company.[119] As a startup or high growth tech company, the borrower in IP Venture Banking does not have hard assets but experiences a high burn rate.[120] The borrower has a few patents or pending patent applications but its technology is important to the enterprise.[121]

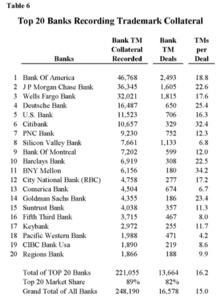

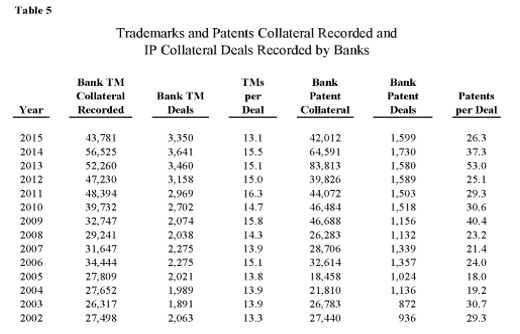

The outlier banks take a security interest in the borrower’s small patent portfolio, averaging about 11.8 patents per deal.[122] Other banks, on the other hand, lend to legacy companies with larger patent portfolios, averaging about 28.4 patents per deal.[123] Table 5 provides the corresponding ratio of trademarks per deal and patents per deal from 2002 to 2015.

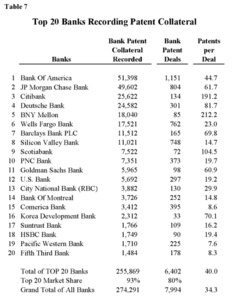

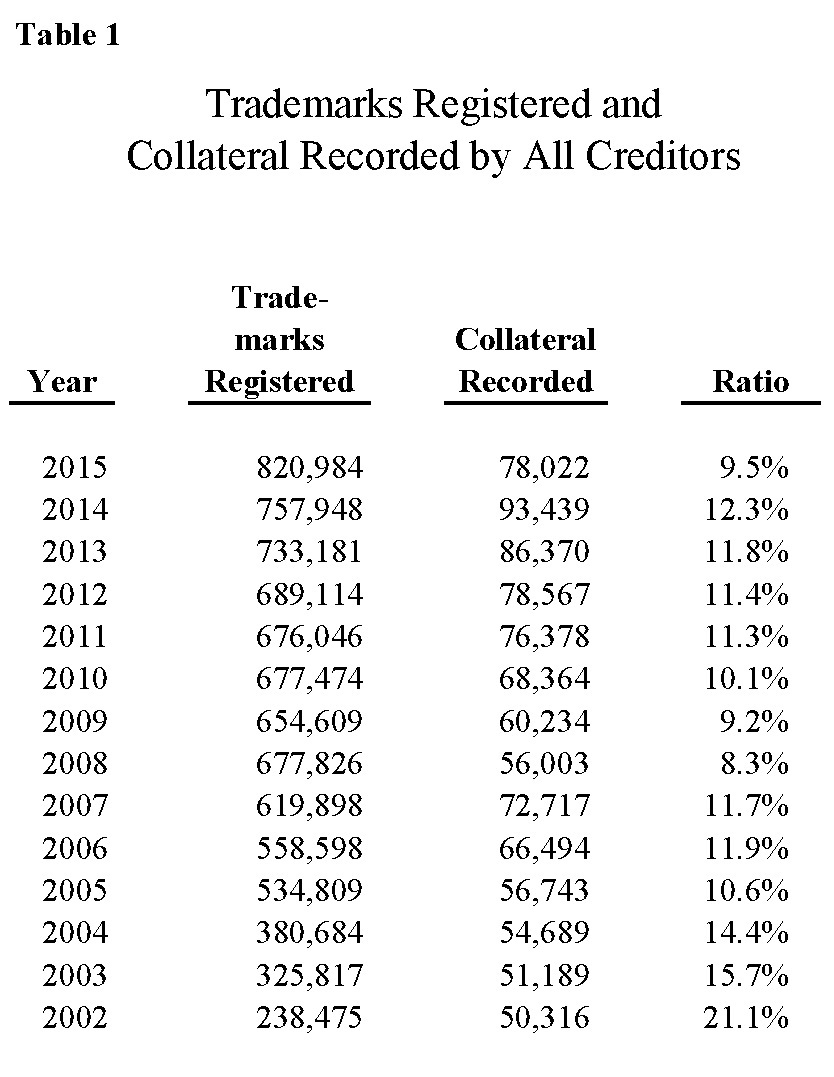

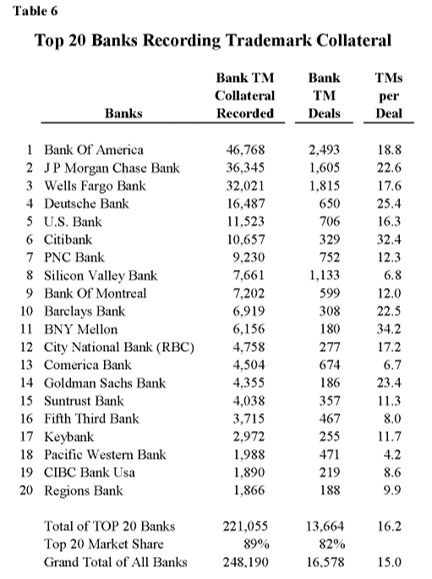

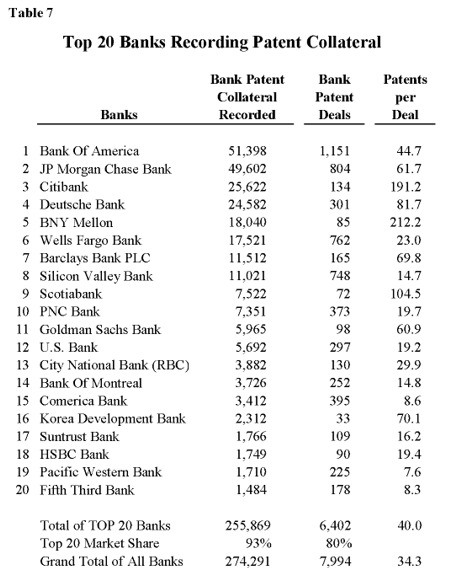

In this paper, we also observe the same lending behavior with trademark collateral recorded by banks. The banks with the low ratio of trademark collateral per deal are the same banks who are leaders in IP Venture Banking. The banks with the high ratio of trademark collateral per deal are the same banks who lend to legacy companies.[124] Table 6 and Table 7 provide the names of top 20 banks with trademark and patent collateral in the last 5 years of data as well as the corresponding ratio of trademark and patent collateral per deal.[125]

In the IP Venture Lending niche, it seems that startups and high growth tech companies use both patents and trademarks as collateral, and outlier banks accept and record these assets as collateral. Patents and patent applications have already been identified as a signal for lenders to rely on the IP Venture Lending niche.[126] No study on the role of trademarks in IP Venture Lending exists. Our finding here that outlier banks do accept and record trademarks as collateral is a new puzzle. Perhaps the trademarks are part of the key driver of the enterprise’s value and that is why outlier banks record the security interest in trademarks. Or, perhaps outlier banks merely take a blanket lien on all the borrower’s assets, including both patents and trademarks.[127] Additional study in the role of trademarks in IP Venture Lending is warranted.

C. Lending Against the Byproduct of Trademarks

Businesses use trademarks in connection with marketing, distributing, and selling their products and services. Through such use the trademark gains recognition in the mind of the consumer and the marketplace accumulates the goodwill associated with the trademark. A trademark in itself does not have value; the trademark’s goodwill does.[128] The trademark’s goodwill is the intangible asset that appears on a company’s balance sheet,[129] and goodwill is the premium value paid to acquire the company.[130] In other words, the economic value of a trademark represents the goodwill in the trademark.[131] Leveraging the goodwill, many trademark owners license their trademark to others, expanding trademark use in different markets and sectors.[132] The licensees do not own the goodwill but generate the goodwill for the benefits of the licensors.[133] The licensees are willing to pay for the licensing fees instead of adopting their own trademarks unknown to the market.[134]

Riding on the existing goodwill of the licensed trademarks, the licensees anticipate that they will be able to distribute and sell products under the licensed trademarks.[135] The future revenue the licensees plan to earn is essentially the byproduct of the trademark goodwill. Lenders can rely on the future revenue the licensees will earn to provide the needed loan to the licensees. This type of asset-based lending does not involve the trademark itself but the future revenue or the byproduct of the trademark’s goodwill. Consequently, lenders have no need to file security interest in the trademarks since there are no trademarks that serve as collateral. This, perhaps, explains the reality in lending and the low ratio of trademarks that serve as collateral in the USPTO database.

Here is an illustration. The University of Alabama owns the “Crimson Tide” trademark. Crimson Tide, of course, enjoys enormous goodwill, as the football team has captured numerous national championship titles. The University licenses Crimson Tide to a three-person company to make merchandise.[136] As the football team was heading to the national football championship game, the small company desperately needed cash to make 60,000 t-shirts. No banks would lend to the company because it had neither a credit rating nor traditional assets. The company turned to an alternative nonbank lender for the loan by pledging as collateral its future revenue. Taking the future revenue as collateral does not trigger any need for filing with the USPTO.

Obviously, trademark owners can use future revenue from their own transactions with others as collateral instead of the above licensee’s scenario. In both cases, if the future revenue is recurrent and predictable, the lending is the typical ABL with traditional accounts receivables as assets. For the ABL against accounts receivables or for future revenue to occur, the trademark must have established goodwill. Consequently, the data on trademark collateral filings fail to inform the true picture of secured lending involving trademarks.

VI. Conclusion

The empirical study both contradicts and confirms what we have, thus far, understood about the role of trademarks in financing. Additional inquiry will explain whether trademarks will ever truly be considered as eligible collateral in asset-based financing.

The Authors are grateful to Rosemarie Ziedonis, Boston University for her thoughtful comments and suggestions that we split our original paper into several papers in IP Venture Lending. Thank you to Institute for Intellectual Property & Information Law, University of Houston Law School and participants at the 2018 IPIL/Houston National Conference in Santa Fe.

Brand Finance, Glob. 500 2018, at 16 (Feb. 2018), http://brandfinance.com/images/upload/brand_finance_global_500_report_2018_locked.pdf [http://perma.cc/V2YJ-MEE5].

Id.; see also Jessica Tyler, The 10 Most Valuable Brands in 2018, Bus. Insider (Feb. 5, 2019), http://www.businessinsider.com/most-valuable-brands-in-the-world-for-2018-brand-finance-2018-2 [http://perma.cc/GH8V-KPWA].

Statistical Country Profiles: United States of America, WIPO, http://www.wipo.int/ipstats/en/statistics/country_profile/profile.jsp?code=US [http://perma.cc/WP3G-KRYG] (last visited Nov. 2, 2018).

Sarah Whitten, Chipotle Trademarking “Better Burger” for New Food Chain, CNBC (Mar. 31, 2016, 8:20 AM), https://www.cnbc.com/2016/03/30/chipotle-trademarks-better-burger-for-new-food-chain.html [http://perma.cc/R9A2-2HJP] (reporting the rise in the stock after the company confirmed its trademark filing).

Stephanie Guzman-Barrera, New Details Emerge on Southwest Brands Bid for Flying Star, Albuquerque Bus. First (Aug. 29, 2016, 12:20 PM), https://www.bizjournals.com/albuquerque/news/2016/08/29/new-details-southwest-brands-bid-flying-star.html [http://perma.cc/8EVH-8PRX].

The INTA Annual Meeting registration number for 2017 was 10,668. See Largest INTA Annual Meeting Over the Past 138 Years!, Int’l Trademark Ass’n, http://www.inta.org/2017Annual/pages/Home.aspx [http://perma.cc/7A6Z-LLS5] (last visited Nov. 2, 2018).

See Morgan v. Rogers, 19 F. 596, 598 (C.C.D.R.I. 1884) (holding that the chattel mortgage covered the trademark in dispute).

See, e.g., The Creditors’ Comm. of TR–3 Indus., Inc. v. Capital Bank (In re TR–3 Indus.), 41 B.R. 128, 129, 131–32 (Bankr. C.D. Cal. 1984) (stating that Capital Bank made advances in total of $2,502,711.20 to the debtor and received a security interest in accounts receivable, inventory, equipment chattel paper, returned goods and general intangibles, inclusive of trademarks); Wonder Indus. v. Chimneys, Chimes 'N Chairs Inc. (In re Chimneys, Chimes 'N Chairs, Inc.), 17 B.R. 776, 777 (Bankr. N.D. Ohio 1982) (stating that the Old Phoenix National Bank accepted inventory, office equipment, furnishings, fixtures, lease rights, accounts receivables, and trademarks as collateral for the $144,450 loan).

Lending against a corporate asset is “asset-based lending” (ABL) and the amount of the loan is dependent on the quality of the assets. See Kimberly C. MacLeod et al., Asset-Based Lending Credit Facilities: The Borrower’s Perspective, Bus. L. Today, Feb. 2017, at 1 (“ABL literally means asset-based loan; thus, it is no surprise that the foundation of any ABL facility is the assets supporting the borrowing base. Unlike a cash-flow facility, where the lenders look to the borrower’s future cash flow, availability of the loan in an ABL facility is driven by the quality and value of the ‘borrowing base assets.’”).

Secured transactions law permits a wide range of personal property as collateral including inventory, equipment, farm products, investment property, instruments, account receivables, and general intangibles. See U.C.C. § 9-102 (Am. Law Inst. 2017) (listing the definitions of different types of collateral); see also UCC Article 9, Secured Transactions (1998) Summary, Unif. Law Comm’n, http://www.uniformlaws.org/ActSummary.aspx?title=UCC Article 9, Secured Transactions (1998) [http://perma.cc/972F-QZYW] (last visited Nov. 2, 2018).

See generally Xuan-Thao Nguyen, Financing Innovation: Legal Development of Intellectual Property as Security in Financing, 1845–2014, 48 Ind. L. Rev. 509, 548–50 (2015) (arguing that the history of legal development of patents, copyrights and trademarks as collateral should be a source of comfort to lenders for embracing the borrower’s intellectual property corporate assets in financing).

See infra Part III.

See infra Part IV.

See Xuan-Thao Nguyen & Erik Hille, Disruptive Lending for Innovations, 21 U. Pa. J. Bus. L. (forthcoming Jan. 2019).

Kevin Roose et al., Zuckerberg Gets a Crash Course in Charm. Will Congress Care?, N.Y. Times (Apr. 8, 2018), https://www.nytimes.com/2018/04/08/technology/zuckerberg-gets-a-crash-course-in-charm-will-congress-care.html [http://perma.cc/9Z8N-RKJD] (reporting that Facebook spent weeks trying to transform its public image through a team of 500 employees in policy and communications, and preparing Zuckerberg for his testimony in Congress with a hired team of experts and coaches; Hayden Field, Mark Zuckerberg Has Been Doing Extensive Prep for His Congressional Hearing: Here’s What to Expect, Entrepreneur (Apr. 10, 2018), https://www.entrepreneur.com/article/311754 [http://perma.cc/A8H8-P8GX] (discussing Zuckerberg’s preparation and prepared testimony for his Congressional hearings); Shona Ghosh, Facebook Is Quickly Coaching Mark Zuckerberg on How to Be Charming, Bus. Insider (Apr. 9, 2018, 4:30 AM), https://www.businessinsider.com/mark-zuckerberg-facebook-coached-experts-congress-testimony-2018-4 [http://perma.cc/G8XB-AY2N] (explaining how Zuckerberg was preparing on the charm offensive); Nicholas Thompson & Fred Vogelstein, Inside the Two Years that Shook Facebook and the World, How a Confused, Defensive Social Media Giant Steered Itself Into a Disaster, and How Mark Zuckerberg Is Trying to Fix It All, Wired (Feb. 12, 2018, 7:00 AM), https://www.wired.com/story/inside-facebook-mark-zuckerberg-2-years-of-hell/ [http://perma.cc/RWW9-JFXZ] (tracing the Facebook privacy scandal and Zuckerberg’s strategy to save Facebook).

Jena McGregor, Facebook CEO Mark Zuckerberg Has Apologized—Again, Wash. Post (Apr. 11, 2018), https://www.washingtonpost.com/news/on-leadership/wp/2018/04/10/facebook-ceo-mark-zuckerberg-is-apologizing-again/?utm_term=.1fe9653a05f8 [http://perma.cc/F5PT-72K3] (recounting Zuckerberg’s admission of: “It was my mistake, and I’m sorry,” and several lawmakers’ view that Zuckerberg’s statement is part of the “apology tours”); David Gilbert, Here Are All the Questions Zuckerberg Promised Lawmakers His “Team” Would Answer, Vice News (Apr. 12, 2018), https://news.vice.com/en_ca/article/qvxxj7/facebook-questions-zuckerberg-congress [http://perma.cc/M8WT-9L63] (detailing how Zuckerberg has repeatedly deflected questions to stay on the charm offensive).

Brigitte Majewski et al., Facebook Fumbles Its Own Brand Crisis, Forbes (Apr. 20, 2018) https://www.forbes.com/sites/forrester/2018/04/20/facebook-fumbles-its-own-brand-crisis/#783b46d03f21 [http://perma.cc/6KHD-YKDP] (dissecting how Facebook has poorly managed its crisis and detailing the four components of “brand in crisis” management); Dylan Byers, Facebook is Facing an Existential Crisis, CNN (Mar. 19, 2018, 10:40 AM), https://money.cnn.com/2018/03/19/technology/business/facebook-data-privacy-crisis/index.html [http://perma.cc/P2XK-L2PV] (reporting that the Cambridge Analytica scandal has done “immense damage to the brand”); Fox Business, How Mark Zuckerberg Should Handle Facebook’s Brand Crisis, YouTube (Apr. 10, 2018), https://www.youtube.com/watch?v=zvuVVBcUPKI [http://perma.cc/96G2-99YW].

Tim Cook has declared in a town hall meeting hosted by MSNBC that “You are not our product . . . . You are our customer. You are a jewel, and we care about the user experience, and we’re not going to traffic in your personal life.” Avi Selk, Apple’s Tim Cook: I Would Have Avoided Facebook’s Privacy Mess, Wash. Post (Mar. 29, 2018), https://www.washingtonpost.com/news/the-switch/wp/2018/03/29/apples-tim-cook-i-would-have-avoided-facebooks-privacy-mess/?noredirect=on&utm_term=.8ce1d39a496b [http:// perma.cc/LE2U-C6SK] (reporting how Tim Cook emphasized that Apple does not monetize its customer compared to Facebook’s business model of selling its customers as products).

Sarah Halzack, The CEO of Starbucks Just Passed His Biggest Leadership Test Yet, Bloomberg (Apr. 18, 2018, 7:54 AM), https://www.bloomberg.com/gadfly/articles/2018-04-18/starbucks-ceo-kevin-johnson-aces-this-leadership-test (praising Kevin Johnson for his leadership in steering the Starbucks empire through crisis); Marcel Schwantes, Starbucks’s CEO Showed a Classy Example of What a Great Leader Does When Managing a Crisis, Inc. (Apr. 17, 2018), https://www.inc.com/marcel-schwantes/starbuckss-ceo-showed-a-classy-example-of-what-a-great-leader-does-when-managing-a-crisis.html [http://perma.cc/9GB2-F25C] (identifying how Kevin Johnson swiftly and thoughtfully addressed the crisis).

Deven R. Desai, From Trademarks to Brands, 64 Fla. L. Rev. 981, 986–87 (2012) (explaining how brands forge a connection with consumers and involve consumers and communities as stakeholders in the brands); Deborah R. Gerhardt, Consumer Investment in Trademark, 88 N.C. L. Rev. 427, 453–54 (2010) (discussing how success brands function as representative symbols of a culture or movement through collateral models that inspires consumer investments). For a discussion of how Starbucks’s trademark embodies its product and culture, see Robert Flazer, Lessons in Crisis Management From Facebook and Starbucks, Forbes (Apr. 26, 2018, 9:00 AM) https://www.forbes.com/sites/robertglazer/2018/04/26/lessons-in-crisis-management-from-facebook-and-starbucks/#6ac01c8156c8 [http://perma.cc/T8TV-58NN] (discussing what Facebook “has been, historically” and what Zuckerberg must do to restore its culture in order to inspire the confidence in the public “that depends upon its services” because “culture is where the rubber meets the road” for what Facebook has meant for its employees and public, and stating that building an “accountable culture” will save “a business from even the most dire public relations disaster”); Halzack, supra note 19 (describing Starbucks’ efforts to build a culture of inclusivity including hiring refugee employees and selling new products that embrace inclusivity).

Kurt Badenhausen, Apple Heads the World’s Most Valuable Brands of 2017 at $170 Billion, Forbes (May 23, 2017), https://www.forbes.com/sites/kurtbadenhausen/2017/05/23/apple-heads-the-worlds-most-valuable-brands-of-2017-at-170-billion/#53258626384b [http://perma.cc/GX9D-D8K2] (“Brand value is the ultimate currency craved by companies.”). Forbes provides valuations of brands in industries from Aerospace, Apparel, to Transportation. See The World’s Most Valuable Brands, Forbes, https://www.forbes.com/powerful-brands/list/ [http://perma.cc/FB9G-VEKK] (last visited Nov. 2, 2018).

For example, Starbucks has a valuation of $16.2 billion in 2018 in the “restaurant” list in Forbes. The Starbucks trademark enjoyed $21.9 billion in product sales for the same year, and its brand value increased by 9% in one year. See The World’s Most Valuable Brands: Starbucks, Forbes, https://www.forbes.com/powerful-brands/list/#tab:rank_search:starbuck [http://perma.cc/9KCS-4L44]. For methodologies in valuing brand equity, see Lindsey Trent & Jakki Mohr, Marketers’ Methodologies for Valuing Brand Equity, Insights into Accounting for Intangible Assets, CPA Journal (Aug. 2017), https://www.cpajournal.com/2017/08/02/marketers-methodologies-valuing-brand-equity/ [http://perma.cc/3BYP-UGXY].

Badenhausen, supra note 21 (“A valuable brand spurs demand and creates pricing power.”).

See Emma K. Macdonald, Hugh N. Wilson & Umut Konus, Better Customer Insight—in Real Time, Harv. Bus. Rev. (Sept. 2012), https://hbr.org/2012/09/better-customer-insight-in-real-time [http://perma.cc/2DKM-K8GZ] (explaining how Unilever, BSkyB, PepsiCo, Schweppes, HP, Energizer, Microsoft, InterContinental Hotels, and SAS have used real-time experience tracking (RET), a new research tool, to better under their customers’ encounters with companies and their brands). McKinsey also conducted a study on branding to business customers and identified factors that have direct influence on a company’s short-term and long-term prospects. See McKinsey Mktg. & Sales Practice, Business Branding: Bringing Strategy to Life, http://www.birdsonggregory.com/wordpress/wp-content/uploads/2015/07/B2B_branding_strategy_whitepaper.pdf [http://perma.cc/ZY7M-2999].

Brand Awareness Survey, SurveyMonkey, https://www.surveymonkey.com/mp/brand-awareness-survey-template/ [http://perma.cc/LT52-U6X3] (last visited Nov. 2, 2018); Bret Kershner, The Definitive Guide to Brand Awareness Studies, SurveyGizmo (Aug. 18, 2016), https://www.surveygizmo.com/resources/blog/the-definitive-guide-to-brand-awareness-studies/ [http://perma.cc/2E8M-CR9H].

Scott Levy, Brand Visibility: Techniques and Tactics, Entrepreneur (Feb. 11, 2014), https://www.entrepreneur.com/article/230890 [http://perma.cc/4FGT-WYAA] (advising all companies that a “brand becomes visible by being shared, read and seen on social media, as well as on traditional media. From logos to slogans to photos to tweets, posts and advertising, your message must be consistent.”); Forbes Commc’n Council, Nine Creative Strategies to Drive Your Organization’s Brand Visibility, Forbes (Mar. 20, 2018, 7:00 AM), https://www.forbes.com/sites/forbescommunicationscouncil/2018/03/20/nine-creative-strategies-to-drive-your-organizations-brand-visibility/#2197a8444c8a [http://perma.cc/2UNZ-XP5E].

For dying or dead trademarks, some companies have attempted various tactics to bring them back to life. See Corey Tollefson, Retail Zombies: The Resurrection of Dying (or Dead) Brands, Total Retail (Apr. 2, 2018), http://www.mytotalretail.com/article/retail-zombies-the-resurrection-of-dying-or-dead-brands/ [http://perma.cc/DG9U-3JQU] (identifying companies with known brands that lost visibility and existence by failure to recognize the customer-driven shift to personalization, among other mistakes); Jim Campisano, Dead Brands & Why We Love Them, Power Nation (May 5, 2015), https://www.powernationtv.com/post/dead-brands-why-we-love-them [http://perma.cc/A8XM-EA6C] (explaining what killed known brands).

See generally Xuan-Thao N. Nguyen, Holding Intellectual Property, 39 Ga. L. Rev. 1155, 1163–67 (2005).

For example, VF Corporation created a trademark holding company to avoid state tax on the royalty income from the Lee and Wrangler trademarks. See Surtees v. VFJ Ventures, Inc., 8 So. 3d 950, 957, 968–69 (Ala. Civ. App. 2008); see also Talbots, Inc. v. Comm’r, 944 N.E.2d 610, 612 (Mass. App. Ct. 2011) (finding sham transactions involving trademarks to avoid state tax on royalty income).

See NIHC, Inc. v. Comptroller of the Treasury, 97 A.3d 1092, 1092–93 (Md. 2014) (describing the tax avoidance scheme of trademark assignment and license back between the parent company and its wholly-owned subsidiary and analogizing the scheme to a basketball maneuver, “four corners offense”); A & F Trademarks, Inc. v. Tolson, 605 S.E.2d 187, 189 (N.C. Ct. App. 2004) (similar tax avoidance pattern); Geoffrey, Inc. v. S.C. Tax Comm’n, 437 S.E.2d 13, 15 (S.C. 1993).

See generally Jeffrey A. Maine & Xuan-Thao Nguyen, The Intellectual Property Holding Company: Tax Use and Abuse from Victoria’s Secret to Apple 56–57 (2017).

The International Trademark Association’s annual meeting of trademark attorneys convenes to discuss the latest legal issues related to trademarks and to maintain their network reaches beyond 10,000 attendees. See Largest INTA Annual Meeting Over the Past 138 Years!, supra note 6.

See Lex Machina’s Trademark Litigation Report Provides Comprehensive and Accurate Insights on Trademark Litigation Data, Lex Machina (May 1, 2015), https://lexmachina.com/media/press/accurate-insights-on-trademark-litigation-data/ [http://perma.cc/PJ4D-EPJ3] (stating that more than 24,000 trademark cases have been filed from 2009 to 2014, and over 4,000 new cases filed in 2014).

Id. (reporting that companies in the music, film, and fashion industries tend to file trademark litigation in the Central District of California, luxury brand companies gravitate to the Southern District of Florida as litigation forum of choice, and companies with major brands in fashion sought help from the Southern District of New York and the Northern District of Illinois).

Companies bring trademark suits to prevent harm to their goodwill from unauthorized use. See, e.g., Church of Scientology Int’l v. Elmira Mission of the Church of Scientology, 794 F.2d 38, 43 (2d Cir. 1986) (“The unauthorized use of a mark by a former licensee invariably threatens injury to the economic value of the goodwill and reputation associated with a licensor’s mark.”); Ark. Best Corp. v. Carolina Freight Corp., 60 F. Supp. 2d 517, 520 (W.D.N.C. 1999) (“Defendants’ unauthorized use of Plaintiffs’ federally registered service mark presents an undeniable threat to Plaintiffs’ reputation and goodwill and, therefore, creates imminent irreparable harm.”); Hollywood Athletic Club Licensing Corp. v. GHAC-CityWalk, 938 F. Supp. 612, 614–16 (C.D. Cal. 1996) (finding that the licensee’s unauthorized use of the licensor’s trademarks risks the licensor’s “business relations, reputation, and goodwill”).

Trademark enforcement is necessary to avoid consumer confusion. See Carl Zeiss Stiftung v. V.E.B. Carl Zeiss, Jena, 298 F. Supp. 1309, 1314 (S.D.N.Y. 1969) (“[T]he purpose of trademark enforcement is to avoid public confusion that might result from imitation or similar unfair competitive practices.”). Failure to enforce trademark rights has serious consequences. See Knaack Mfg. Co. v. Rally Accessories, Inc., 955 F. Supp. 991, 1003 (N.D. Ill. 1997) (applying the likelihood of confusion factors and finding the strength of the plaintiff’s trademark was “undermined by its uneven trademark enforcement efforts against numerous third-party users”).

See infra Table 4.

The USPTO Performance and Accountability Report FY 2017 states that trademark filings increased by 12% in the fiscal year. See USPTO, Performance and Accountability Report FY 2017, at 2, 59 (2017), https://www.uspto.gov/sites/default/files/documents/USPTOFY17PAR.pdf [http://perma.cc/UN9M-CGSG].

Id. at 184 (reporting 538,605 pending applications representing 771,004 classes of goods and services during FY 2017).

There are more than 3,000 law review articles with trademarks in the titles, per a Westlaw search conducted on April 27, 2018.

See Robert G. Bone, Trademark Functionality Reexamined, 7 J. Legal Analysis 183, 225 (2015) (“A firm with a choice between patent and trademark will choose the option that gives it a greater expected return on its research investment. If that option is trademark law, the firm does better with the trademark option and will have stronger incentives than it would if only the patent were available. If the superior option is patent, the firm is no worse off for having the trademark option, too.”).

The history of trademark collateral spans from at least 1875 to the present. See Morgan v. Rogers, 19 F. 596, 597 (C.C.D.R.I. 1884) (permitting “Dr. Haynes’ Arabian Balsam” trademark to serve as collateral for a loan of $48,500 in 1875); Tuttle v. Blow, 75 S.W. 617, 618 (Mo. 1903) (describing the trademark collateral in the chattel mortgage for securing eight promissory notes with aggregate value of $25,817.64 executed in 1889); Opacmare USA, LLC v. Lazzara Custom Yachts, LLC, 314 F. Supp. 3d 1276, 1278 (M.D. Fla. 2018) (stating that the trademark LAZZARA was the collateral to secure a $15 million revolving credit loan executed in 2007).

See Nguyen, supra note 11, at 510–11 (2014) (tracing the history from chattel mortgage with trademarks to secured transactions with trademark collateral).

Id. at 522.

Id. at 524, 527.

See, e.g., Bateman v. GemCap Lending I, LLC, No. 17–00087 JMS–KJM, 2017 WL 4786092, at *1–2, *6 (D. Haw. Mar. 15, 2017) (stating that the creditor received a grant of security interest in the trademark collateral and imposed limits on what the debtor can do with the trademark collateral during the duration of the loan); In re Chimneys, Chimes 'N Chairs, Inc., 17 B.R. 776, 780 (Bankr. N.D. Ohio 1982) (noting that “it has been stipulated that the Bank has a valid and perfected security interest” in the trademarks and other collateral).

Joy Group Oy v. Supreme Brands L.L.C., No. 15-3676 (DWF/FLN), 2016 WL 2858794, at *3 (D. Minn. May 16, 2016) (“Article 9 of the Minnesota UCC provides a comprehensive scheme for the regulation of security interests that are obtained in personal property to secure a debt.”).

If the creditor fails to follow Article 9 requirements in perfecting the security interest in trademark collateral, the bankruptcy trustee will avoid the security interest. See Morris v. Snap-On Credit, LLC (In re Jones), 2006 WL 3590097, at *2–3 (Bankr. D. Kan. Dec. 7, 2006) (finding that the creditor did not properly perfect its security interest in the trademark because the filing document did not use the debtor’s full legal name, Christopher Gary Jones, thus allowing the bankruptcy trustee to avoid the security interest).

See U.C.C. § 9-109(a) (Am. Law Inst. 2017) (providing the scope of secured transaction law).

See id. § 9-102(a) (indexing a comprehensive list of definitions).

See id. § 9-201(a) (explaining a security agreement).

See id. § 9-203 (requiring conditions for a security interest attachment to be enforceable against the debtor).

See id. § 9-501(a) (filing office under state law).

See id. § 9-322(a)(1) (establishing priority amongst conflicting security interests).

The definition of “general intangible” does not mention intellectual property. The Official Comment explains that the term does mean to include intellectual property.

“General intangible” is the residual category of personal property, including things in action that is not included in the other defined types of collateral. Examples are various categories of intellectual property and the right to payment of a loan of funds that is not evidenced by chattel paper or an instrument. As used in the definition of general intangible, things in action includes rights that arise under a license of intellectual property, including the right to exploit the intellectual property without liability for infringement.

Id. § 9-102 cmt. 5.d.General intangibles have no physical embodiment for perfection by possession. See id. § 9-313 (providing when perfection by possession can occur with specific types of collateral).

Id. § 9-109(c)(1) (providing a framework for federal preemption). See Jonathan C. Lipson, Financing Information Technologies: Fairness and Function, 2001 Wis. L. Rev. 1067, 1095–96, 1114–15 (analyzing Article 9’s step back and discussing perfection of security interest in copyrights, patents and trademarks). Other scholars desire a complete federal preemption and advocate for a centralized filing system of intellectual property collateral. See, e.g., Willa E. Gibson, The Intersection Between UCC Article 9 and Intellectual Property: The Need for a National, Centralized Filing System for IP, 15 John Marshall Rev. Intell. Prop. L. 83, 85 (2015); William Murphy, Proposal for a Centralized and Integrated Registry for Security Interest in Intellectual Property, 41 Idea: J. L. & Tech. 297, 298 (2002).

Trimarchi v. Together Dev. Corp., 255 B.R. 606, 610 (D. Mass. 2000) (“An analysis of Article 9 of the U.C.C., the Lanham Act, case law and general policy considerations indicates that the Lanham Act does not preempt the U.C.C.'s filing requirements.”); see also Creditors’ Comm. of TR–3 Indus., Inc. v. Capital Bank (In re TR–3 Indust.), 41 B.R. 128, 131 (Bankr. C.D. Cal. 1984) (finding that “[i]t was not the purpose or intent of Congress in enacting the Lanham Act to provide a method for the perfection of security interests in trademarks, tradenames or applications for the registration of the same”).

Trimarchi, 255 B.R. at 612 (stating that the perfection of a security interest in a trademark is governed by Article 9); see also Roman Cleanser Co. v. Nat’l Acceptance Co. of Am. (In re Roman Cleanser Co.), 43 B.R. 940, 944 (Bankr. E.D. Mich. 1984) (holding that a security interest in a trademark is governed by Article 9 of the UCC).

See U.C.C. § 9-310(a) (Am. Law Inst. 2017) (“[A] financing statement must be filed to perfect all security interests.”); DS Waters of Am., Inc. v. Fontis Water, Inc., 2013 WL 12244921, at *7 (N.D. Ga. Feb. 26, 2013) (stating that the secured party, Stillwater, filed the UCC financing statement); Doolim Corp. v. R Doll, LLC, No. 1:11-CV-2635-MHS, 2009 WL 1514913, at *4 (S.D.N.Y May 29, 2009) (noting that the secured party “filed a UCC financing statement with the New York Secretary of State, claiming a security interest in, among other things, all of Doll’s present and future accounts, inventory and trademarks.”).

U.C.C. § 9-307 (Am. Law Inst. 2017) (providing how to determine a debtor’s location).

Id. § 9-504 (providing that a “financing statement sufficiently indicates the collateral that it covers if the financing statement provides . . . an indication that the financing statement covers all assets or all personal property.”); see ProGrowth Bank, Inc. v. Wells Fargo Bank, N.A., 558 F.3d 809, 812 (8th Cir. 2009) (stating that the financing statement’s function is “not to ‘identify the collateral and define property which the creditor may claim, but rather to warn other subsequent creditors of the prior interest’”). A UCC Financing Statement form is available at https://www.sos.state.tx.us/ucc/forms/UCC1.pdf [http://perma.cc/JJ2K-T3PY].

ProGrowth Bank, 558 F.3d. at 812–13 (“[W]e view the validity of the financing statement in terms of whether ‘it provides notice that a person may have a security interest in the collateral claimed.’ The UCC allows for imperfect financing statements, and it recognizes that sometimes ‘[f]urther inquiry from the parties concerned will be necessary to disclose the complete state of affairs.’” (citation omitted)).

The commentary to U.C.C. § 9-502 states:

Notice filing has proved to be of great use in financing transactions involving inventory, accounts, and chattel paper, because it obviates the necessity of refiling on each of a series of transactions in a continuing arrangement under which the collateral changes from day to day. However, even in the case of filings that do not necessarily involve a series of transactions (e.g., a loan secured by a single item of equipment), a financing statement is effective to encompass transactions under a security agreement not in existence and not contemplated at the time the notice was filed, if the indication of collateral in the financing statement is sufficient to cover the collateral concerned. Similarly, a financing statement is effective to cover after-acquired property of the type indicated and to perfect with respect to future advances under security agreements, regardless of whether after-acquired property or future advances are mentioned in the financing statement and even if not in the contemplation of the parties at the time the financing statement was authorized to be filed.

See also Trimarchi v. Together Dev. Corp., 255 B.R. 606, 612 (D. Mass. 2000) (noting that the “stated purpose of Article 9” is to provide a “simple and unified structure” for secured transactions).Nevertheless, the generic statement is sufficient under secured transactions law. See In re Grabowski, 277 B.R. 388, 392 (S.D. Ill. 2002) (finding that Bank of America’s financing statement indicating that it had a lien of the debtors’ general intangibles was “sufficient to notify subsequent creditors . . . that a lien existed on the debtors’ property”).

The filings of trademark security interests with the US Trademark Office has actually increased over time. See infra Table 1.

For a detailed description of federal and state trademark protection, see J. Thomas McCarthy, McCarthy on Trademarks and Unfair Competition §§ 19:1–22:11 (5th ed. 2018).

Park 'N Fly, Inc. v. Dollar Park & Fly, Inc., 469 U.S. 189, 193 (1985) (“Congress enacted the Lanham Act in 1946 in order to provide national protection for trademarks used in interstate and foreign commerce. . . . Because trademarks desirably promote competition and the maintenance of product quality, Congress determined that a sound public policy requires that trademarks should receive nationally the greatest protection that can be given them. Among the new protections created by the Lanham Act were the statutory provisions that allow a federally registered mark to become incontestable.”).

Two Pesos, Inc. v. Taco Cabana, Inc., 505 U.S. 763, 768 (1992) (“[I]t is common ground that § 43(a) [of the Lanham Act] protects qualifying unregistered trademarks and that the general principles qualifying a mark for registration under § 2 of the Lanham Act are for the most part applicable in determining whether an unregistered mark is entitled to protection under § 43(a).”).

See Tana v. Dantanna’s, 611 F.3d 767, 780–81 (11th Cir. 2010) (comparing the protection for common-law trademarks to federally registered trademarks).

See William H. Widen, Lord of the Liens: Towards Greater Efficiency in Secured Syndicated Lending, 25 Cardozo L. Rev. 1577, 1615 (2004) (discussing what and where secured creditors file to protect their security interests in intellectual property assets).

Only lower courts from the districts of Massachusetts, Michigan, Tennessee and California have addressed the perfection of security interest in trademarks. See, e.g., Trimarchi v. Together Dev. Corp., 255 B.R. 606 (D. Mass. 2000); In re Chattanooga Choo-Choo Co., 98 B.R. 792, 794 (Bankr. E.D. Tenn. 1989); The Creditors’ Comm. of TR–3 Indus., Inc. v. Capital Bank (In re TR-3 Indus.), 41 B.R. 128, 131 (Bankr. C.D. Cal. 1984); Roman Cleanser Co. v. Nat’l Acceptance Co. of Am. (In re Roman Cleanser Co.), 43 B.R. 940, 944 (Bankr. E. D. Mich. 1984).

See Widen, supra note 71, at 1615 (“As a matter of secured financing practice, lenders often require filings with the Patent and Trademark Office to reflect security interests in patents and trademarks even though case law suggests that such filings are not necessary to provide protection against a bankruptcy trustee.”); see also In re Nuverra Envtl. Sols., Inc., No. 17–10949 (KJC), 2017 WL 5483147, at *6 (Bankr. D. Del. Jun. 6, 2017) (noting that security interests in the collateral “were properly perfected by ‘(A) the filing of UCC financing statements, with the Debtors, as debtors, and the Existing Revolving Facility Agent, as secured party; . . . [and] (C) the filing of intellectual property security agreements, with the Debtors, as grantors, and the Existing Revolving Facility Agent, as secured party, with the United States Patent and Trademark Office and the United States Copyright Office, as appropriate.’”).

Widen, supra note 71, at 1615 n.125 (explaining a potential problem with the belts and suspenders approach if the filing is an assignment of intent-to-use trademark application as part of the overall secured transaction); see also Clorox Co. v. Chem. Bank, 40 U.S.P.Q.2d (BNA) 1098 (T.T.A.B. 1996) (prohibiting assignment of intent-to-use trademark application).

See, e.g., Three Rivers Confections, LLC v. Warman, 660 F. App’x 103, 105 (3d Cir. 2016) (noting that the lenders filed UCC-1 financing statement with the Office of the Secretary of State of Pennsylvania to perfect their security interests in the trademarks).

Spencer Williams, Venture Capital Contract Design: An Empirical Analysis of the Connection Between Bargaining, 23 Fordham J. Corp. & Fin. L. 105, 123–24 (2017) (explaining equity financings and control issue).

See id. at 136–42 (providing an overview of debt financings, terms and lower cost compared to equity financings).

“Banks” mean community and commercial banks, and they are typically FDIC-insured depository institutions. Are All Bank Accounts Insured by the FDIC?, Investopedia (June 2018), https://www.investopedia.com/ask/answers/08/fdic-insured-bank-account.asp [http://perma.cc/T4TM-MBM2] (stating that a bank that is not “FDIC insured cannot compete effectively in an industry where consumers have come to expect their money to be protected”); see also John Erwin Trytek, Nonbank Banks: A Legitimate Financial Intermediary Emerges from the Bank Holding Company Act Loophole, Comment, 14 Pepp. L. Rev. 107, 110–29 (1986) (tracing the rise of nonbanks in the financial market).

Christian A. Johnson, Holding Credit Hostage for Underwriting Ransom, Rethinking Bank Antitying Rules, 64 U. Pitt. L. Rev. 157, 178–79 (2002) (comparing investment banks to commercial banks and asserting that investment banks are at a disadvantage when they compete with commercial banks because unlike their counterparts, “investment banks do not have access to cheap deposits that can be lent at inexpensive interest rates”).

Note, Danger Lurking in the Shadows: Why Regulators Lack the Authority to Effectively Fight Contagion in the Shadow Banking System, 127 Harv. L. Rev. 729, 732 (2013) (“Because of the liquidity advantage that deposits offer depositors, banks are able to offer very low interest rates on deposits, which makes them a very cheap source of funding—usually the cheapest available.”).

Helen A. Garten, Regulatory Growing Pains: A Perspective on Bank Regulation in a Deregulatory Age, 57 Fordham L. Rev. 501, 516 (1989) (“The power to take deposits, particularly given the protection afforded by deposit insurance and interest rate ceilings, not only provided banks with a cheap source of funding, but also enabled banks to build relationships with potential customers for other bank products, such as lines of credit, mortgages or credit cards.”).

See Overnight Bank Funding Rate Data, Fed. Reserve Bank N.Y., (Aug. 16, 2018), https://apps.newyorkfed.org/markets/autorates/obfr [http://perma.cc/3X5H-EX4M] (“The federal funds market consists of domestic unsecured borrowings in U.S. dollars by depository institutions from other depository institutions and certain other entities, primarily government-sponsored enterprises . . . .”).

Overnight Rate, Investopedia, https://www.investopedia.com/terms/o/over nightrate.asp [http://perma.cc/J2ZE-837M] (last visited Nov. 2, 2018). The overnight lending rate ranges from 1.25% to 1.5%. Stephen Gandel, Now It’s the Fed That Appears to Be Moving Slowly: The 10-year Treasury Yield Takes Off While the Overnight Lending Rate Stands Still, Bloomberg (Jan. 31, 2018), https://www.bloomberg.com/gadfly/articles/2018-01-31/fed-decision-now-it-s-the-central-bank-that-seems-to-be-slow [http://perma.cc/T4HC-BTQN].

Nonbanks are financial institutions without banking licenses and they are not supervised by a national banking regulatory agency. See Judge Thomas L. Perkins, The Origins of the Subprime Mortgage Crisis, Attorneys’ Title Guar. Fund (Oct. 2008), https://www.atgf.com/tools-publications/trusted-adviser/atg-trusted-adviser-october-2008-title-judge-perkinss-presentation [http://perma.cc/BF7X-N3M7] (“[S]tate regulation is really nonexistent with regard to the substance of the transactions in which they are engaged, so it really is a situation where these nonbank lenders are, for all intents and purposes, simply unregulated by any government regulatory agency.”); Jeremy Estabrooks & Kristin Fisher, Shadow Banking Demystified, Prac. L. Co. art. 4-506-7309 (July 1, 2011) (noting that unregulated or shadow banking has become an “important source of credit activity, financing roughly 30% of total financial assets in the U.S”).

A stark example of nonbanks’ high-interest and high-cost loans is in the payday loan niche. See Creola Johnson, Congress Protected the Troops: Can the New CFPB Protect Civilians from Payday Lending?, 69 Wash. & Lee L. Rev. 649, 659 n.37 (2012) (noting that an online lender imposed an interest of 1140.63% on an eight-day loan and 260.71% on a thirty-five-day loan).

The FDIC and the Banking Industry: Perspective and Outlook, FDIC, https://www.fdic.gov/about/strategic/strategic/bankingindustry.html [http://perma.cc/N6WN-2XVS] (last visited Nov. 2, 2018) (explaining the FDIC as the primary federal regulator of federally insured state-chartered banks that are not members of the Federal Reserve System); Arthur E. Wilmarth, Jr., The Expansion of State Bank Powers, the Federal Response, and the Case for Preserving the Dual Banking System, 58 Fordham L. Rev. 1133, 1152–54 (1990) (tracing the development of the dual banking—federal and state—system in the United States).

See Warren Lee, 7 Reasons Banks Not Lending to Small Businesses, The Lending Mag. (Nov. 13, 2015), https://thelendingmag.com/banks-not-lending-to-small-business/ [http://perma.cc/546V-HXRT] (asserting that “heightened regulation standards have caused banks to be extra-careful about the risk in their investment portfolios and drastically tighten up standards. . . . Unfortunately, small businesses are inherently riskier than huge corporations, which makes banks hesitant about extending credit to them.” Moreover, banks require physical property as collateral. “This makes it hard for startups and new businesses that may not have real estate or valuable equipment to offer as collateral, and small business owners may be uncomfortable using their personal assets (family homes and automobiles) as business loan collateral.”).

See Comptroller’s Handbook: Asset-Based Lending, Office of the Comptroller of Currency 1 (Jan. 27, 2017), https://www.occ.gov/publications/publications-by-type/comptrollers-handbook/asset-based-lending/pub-ch-asset-based-lending.pdf [http://perma.cc/B5N4-8VAW] (“ABL is a specialized loan product that provides fully collateralized credit facilities to borrowers that may have high leverage, erratic earnings, or marginal cash flows.”). An ABL is a secured financing governed by Article 9 of the Uniform Commercial Code. See generally Robert E. Scott, A Relational Theory of Secured Financing, 86 Colum. L. Rev. 901 (1986) (providing a theoretical justification for the relationship between debtor and creditor, the function of assets serving as security, and priority rules for distribution of the debtor’s assets).

Asset-Based Lending, Bank Am. Merrill Lynch, https://www.bofaml.com/en-us/content/bank-of-america-business-capital-team.html [http://perma.cc/33EZ-97ZR] (last visited Nov. 2, 2018); Comptroller’s Handbook: Asset-Based Lending, supra note 88, at 3.

Asset-Based Lending, supra note 89.

Id. (stating that midsized and large companies use ABL for working capital, acquisition, turnaround financing, capital expenditures, refinancing/restructuring, buyout, growth, debtor-in-possession financing, among others). Banking examiners and bankers follow the ABL guidance issued by the Office of the Comptroller of the Currency regarding “credit analysis, evaluating borrower liquidity, establishing a borrowing base and prudent advance rates, collateral controls and monitoring systems, and credit risk rating considerations.” Asset-Based Lending Description: New Comptroller’s Handbook Booklet and Rescissions, Office of the Comptroller of Currency (Mar. 27, 2014), https://www.occ.treas.gov/news-issuances/bulletins/2014/bulletin-2014-11.html [http://perma.cc/HK7L-5P89].

Trademark Assignment Query Menu, U.S. Patent & Trademark Office, http://assignments.uspto.gov/assignments/q?db=tm [http://perma.cc/88HH-DT9S] (last visited Nov. 2, 2018).

Id.

Trademark Assignee Summary, U.S. Patent & Trademark Office, http://assignments.uspto.gov/assignments/q?db=tm&asne=BANK&page=7279 [http://perma.cc/4DPB-6S5T] (last visited Nov. 2, 2018). We wanted to separate banks from nonbanks that have recorded security interests in trademarks. By law, only entities regulated as banks can use the word “bank” in their names. See Xuan-Thao Nguyen & Erik Hille, Patent Aversion: An Empirical Study of Patents Collateral in Bank Lending, 1980–2016, 9 UC Irvine L. Rev. 141, 149–51 (2018) (discussing Delaware law on when a corporation can use the word “bank” in its name).

Illustratively, Reel/Frame 3719/0766 lists Coleman Company as the assignor and BankWest, Inc. as the assignee, provides the serial and registrations for six different trademarks, and provides the date of recordation of the security interest. Trademark Assignment Details Reel/Frame 3719/0766, U.S. Patents & Trademark Office, http://assignments.uspto.gov/assignments/q?db=tm&reel=3719&frame=0766 [http://perma.cc/HP4Q-GWKD] (last visited Nov. 2, 2018); see also Trademark Assignment Assignor Details: Coleman Co., U.S. Patent & Trademark Office, http://assignments.uspto.gov/assignments/q?db=tm&asnrd=COLEMAN COMPANY [http://perma.cc/LL87-WXTZ] (last visited Nov. 2, 2018) (detailing a trademark query on Coleman Company); Trademark Assignment Details, U.S. Patents & Trademark Office, http://assignments.uspto.gov/assignments/q?db=tm&reel=0515&frame=0879 [http://perma.cc/74S9-GGMV] (last visited Nov. 2, 2018) (showing an example of the “Trademark Assignment Details” page).

Trademark Assignment from Coleman Co. to BankWest, Inc., U.S. Patents & Trademark Office (Feb. 14, 2008), http://assignments.uspto.gov/assignments/assignment-tm-3719-0766.pdf [http:// perma.cc/RQ3L-YHB3].

See USPTO Fee Schedule, U.S. Patent & Trademark Office (Oct. 1, 2018), https://www.uspto.gov/learning-and-resources/fees-and-payment/uspto-fee-schedule [http://perma.cc/MFL8-588B] (listing fee for assignment record per trademark registration ($25), recording trademark assignment first mark per document ($40), and second and subsequent marks in the same document ($25)).

USPTO patent collateral filing data is on file with the Authors. For security interest filings, see infra Table 1; total includes earlier years not included in Table 1.

Patent Assignment Search, Advanced Search, U.S. Patents & Trademark Office, https://assignment.uspto.gov/patent/index.html#/patent/search [http://perma.cc/W4EF-THBL] (last visited Nov. 2, 2018).

Laborers Pension Tr. Fund-Detroit & Vicinity v. Interior Exterior Specialists Co., 824 F. Supp. 2d 764, 771 (E.D. Mich. 2011) (finding that the agreement between the parties “had the hallmarks of a security agreement, not a transfer of ownership”); Sherrill D. Wolford, “Transfer of Ownership”: Uncapping Taxable Value for Property Tax Assessments, 75 Mich. B. J. 302, 304 (1996) (“[E]xamples of conveyances which are not transfers of ownership include: a transfer through foreclosure or through a deed in lieu of foreclosure, a transfer for security or an assignment or discharge of a security interest, a transfer among members of an affiliated group, or a transaction that qualifies as a tax-free reorganization.”).

See generally Nguyen & Hille, supra note 94.

See infra Table 1.

See id.

Nguyen & Hille, supra note 94, at 141–42.

Id. at 145–49; see Nguyen & Hille, supra note 14, at 8–10 (providing a comprehensive discussion of why lenders do not lend against patents).

Nguyen & Hille, supra note 94, at 171–75 (providing an analysis of banking regulations that prevent banks from accepting intellectual property as collateral).

Q&A: Asset-based Lending in Today’s Market, PitchBook (Oct. 5, 2017), https://pitchbook.com/news/articles/qa-asset-based-lending-in-todays-market [http://perma.cc/L4EQ-9Q6L].

Asset-Based Lending: Intellectual Property, Appraisal Econ., https://www.appraisaleconomics.com/asset-based-lending-intellectual-property/ [http://perma.cc/65GZ-T3NL] (last visited Nov. 2, 2018); see also Hugh C. Larratt-Smith, It’s All in a Name: Brands and Trademarks as Loan Collateral, ABF J. (Mar. 2017), http://www.abfjournal.com/%3Fpost_type%3Darticles%26p%3D59017 [http://perma.cc/7DH2-JZCE] (reporting that brands and trademarks are “‘boot collateral’—that is to say, nice to have, but not a deal breaker”).

Larratt-Smith, supra note 108.

Kyle Stock, Asset-Based Lending Grows in Popularity, Wall St. J., Feb. 2, 2010, at B5.

Id.

See Larratt-Smith, supra note 108.

Id.

Id.

Id.

Asset-Based Lending: Intellectual Property, supra note 108 (“Subordinate loans offered by junior lenders with a primary lien on IP assets and a secondary lien on tangible assets (‘bifurcated collateral’ financing transactions).”).

See Nguyen & Hille, supra note 94, at 156.

See Nguyen & Hille, supra note 14, at 7–9.

A warrant is a derivative that confers the right, but not the obligation, to buy or sell a security—normally an equity—at a certain price before expiration. See Warrant, Investopedia, https://www.investopedia.com/terms/w/warrant.asp#ixzz55PvKWdU [http://perma.cc/LDQ3-BN6Q] (last visited Nov. 2, 2018). Banks in IP Venture Lending typically demand a warrant, as the banks can greatly benefit when the borrowers are highly valued at a later exiting stage. See Andy Weyer, Typical Venture Debt Terms, Square 1 Bank (Feb. 24, 2014), https://www.square1bank.com/insights/typical-venture-debt-terms/ [http://perma.cc/99QY-NKK4] (“Most venture banks require financial covenants (e.g., minimum revenue at 75% plan, maximum net loss at 125% plan or minimum equity raise by a certain date), but the overall cost of capital is relatively low (interest rates at 4%-8%, upfront fees at 0.25%-0.50% and warrants at 3%-5%).”). A sample warrant from Square 1 Bank is available at http://contracts.onecle.com/otonomy/square-one-warrant-2012-07-31.shtml [http://perma.cc/UF4U-Y642].

Nguyen & Hille, supra note 14, at 12, 14. These companies are always struggling to survive. See Martin Zwilling, 10 Ways for Startups to Survive the Valley of Death, Forbes (Feb. 18, 2013, 11:30 PM), https://www.forbes.com/sites/martinzwilling/2013/02/18/10-ways-for-startups-to-survive-the-valley-of-death/#8677be669eff [http://perma.cc/2ZAH-VHWF] (describing the difficulty of covering the negative cash flow in the early stages of a startup as the “valley of death”).

Nguyen & Hille, supra note 14, at 22–23; Nguyen & Hille, supra note 94, at 170.

USPTO patent collateral filing data is on file with the Authors. The ratio of patents per deal with outlier banks is typical of the 8.8 patents per deal recorded in 2016 for Silicon Valley Bank, a leading outlier bank. Nguyen & Hille, supra note 14, at 30–31.

USPTO patent collateral filing data is on file with the Authors. The ratio of patents per deal between other banks and legacy companies is typical of the 37 to 860 range of patents per deal for large legacy banks in 2016. Nguyen & Hille, supra note 94, at 165.

See infra Table 6.

We manually checked each of the twenty banks and their clients in the deals. We found that Fifth Third Bank is in the low ratio of patents per deal, but its clients are not high growth startups in the innovation sectors. Fifth Third Bank is not among the outlier banks of IP Venture Banking.