I. Introduction

Sometimes, the price of seeking perfect justice is no justice at all. Perhaps nowhere is this more evident than in trademark law today. Over the last century, courts have both moved from rules to standards in, and increased the complexity of, trademark law. These transitions have not been part of a systemic and coherent plan for trademark law but the result of individual courts attempting to achieve what particular judges in particular cases perceived as justice for the particular parties before them. In seeking perfect justice in individual cases, courts have moved from predictable, but imperfect, rules to more open-ended, and theoretically better-tailored, standards on central issues, such as the scope of trademark protection. When the resulting infringement standard has proven overbroad, they have created a variety of idiosyncratic defenses available to particular defendants in particular cases on particular issues. All of this they have done seeking justice. Yet, through these changes, courts have made trademark litigation both sharply more expensive and more unpredictable. Seeking perfect justice may have improved trademark law’s ability to reach just outcomes for those entities with the resources to afford the increased cost and uncertainty of the system. However, many entities can no longer afford to participate in the system at all. They can afford neither to defend themselves against overreaching assertions of trademark infringement nor to assert their own trademark rights, even against straightforward acts of infringement. For these entities, the judicial desire to achieve perfect justice has meant no justice at all.

As a result of this search for perfect justice, trademark law has become a two-tiered system. In the upper tier, the parties on both sides of a dispute can afford to litigate. For disputes that fall in this tier, trademark law today can achieve reasonably sensible outcomes in most cases. However, in the lower tier, while one party can afford to litigate, the other cannot.[1] For disputes that fall in the lower tier, the party that cannot afford the high and increasing cost of participation in the trademark system loses. They lose not because justice, or some version of it, dictates that they lose but because they cannot afford to participate in the system. Because of this, the trademark system will often resolve two disputes that are nearly identical on the merits differently. Instead of turning on sensible considerations of efficiency, justice, or welfare, resolution will turn solely on which party can afford to litigate.[2]

Unfortunately, although courts created this problem, they are ill-equipped to recognize it, let alone correct it. Courts see only the cases that are brought before them. As a general rule, they will, therefore, see only trademark cases from the upper tier, where both parties can afford to litigate. Because the trademark system tends to produce reasonably sensible outcomes when both parties can afford to litigate, courts see only reasonably just outcomes. They never see trademark cases from the lower tier. By definition, one of the parties in this tier cannot afford litigation. As a result, these disputes are usually resolved before they ever come to court. They may be resolved by one party choosing to avoid conduct to which the party has a formal legal entitlement that it cannot afford to exercise. They may be resolved by a cease-and-desist letter, followed by a quick settlement. Or they may be resolved by the filing of a complaint, followed by settlement. But they will seldom be resolved through a full course of litigation. As a result, courts will almost never see the injustice that the current trademark laws inflict. They will see the outcomes only in those cases in which both parties can afford to litigate. So long as trademark law produces just outcomes in those cases, courts will see justice for some and assume that that means justice for all.

Perversely, it is the desire of judges to do justice that has brought us to this state of injustice. If judges had only followed the law instead, justice might have been achieved. But when trademark law led to seemingly unjust outcomes in the case before them, courts refused to follow the law. Instead, to ensure a just outcome in the case before them, courts rewrote trademark law. This was and is a mistake. Courts can never determine the optimal set of legal rules for all potential trademark disputes. They don’t see the big picture. They see only the little picture of the case before them. Unfortunately, in trademark law, the little picture is not always, or even usually, representative of the big picture. For that reason, even if courts could devise the optimal legal rules for the litigated cases, those legal rules would not be optimal for the full range of potential disputes.

To correct this, Congress and courts should return us to the simpler rules of yesteryear. Trying to achieve perfect justice in trademark law effectively excludes many small and medium-sized businesses from meaningful participation in the trademark system. Exclusion represents a more fundamental form of injustice—a difference in kind. In contrast, the imperfect justice that simple rules achieve is merely a form of injustice different in degree.

We begin our examination of trademark’s two-tiered system with a tale of two cases that illustrate the two tiers. On the merits, the two cases are very similar. Yet, the trademark system resolved them quite differently. In the first, both parties could afford to litigate. In the second, one party, the defendant, could not. As a result, in the first, the defendant was allowed to continue its use. In the second, the defendant was prohibited from doing so. Section III examines how the trademark system has arrived at this state. It demonstrates that the desire of judges to do justice led them to change trademark law so that they could reach their desired result in a given case. Unfortunately, because of stare decisis, changing trademark law in a particular case does not change the law just for that case. Instead, when judges make things up, it becomes the law for all future cases. Unfortunately, all judges see is the case right in front of them. What may seem perfectly sensible for that case often becomes pernicious when applied to the full range of potential trademark disputes. And even when sensible across a broad range of disputes, a “more perfect” formulation of trademark law is often far more expensive to administer and uncertain in its applicability. Section IV illustrates how this increased cost and uncertainty generates a two-tiered trademark system. Despite the theoretical advantages of a more perfect standard over a less perfect rule, Section IV demonstrates that when one party cannot afford the higher administrative cost and greater uncertainty of the standard, switching from the rule to the standard leads to injustice.

Before we begin, let me acknowledge at the outset that the access-to-justice concerns I identify are not unique to trademark law. Nor are they the only difficulty that small businesses face today. Nevertheless, focusing on the costs of complexity in trademark law can serve both as a cautionary tale regarding the costs of complexity generally and as a reminder that complexity is desirable, given its inevitable costs, only if it achieves some real welfare gains. In trademark law, that is not the case. Compared to far simpler and less expensive rules, in trademark law, the more costly and complex standards courts have adopted exclude many from participation and yet yield no offsetting welfare gains.

II. A Tale of Two Cases

We begin with an example of the two-tiered trademark system in operation. In November 1972, Standard Oil of New Jersey renamed and rebranded itself Exxon.[3] Before that time, it had operated under three different marks. In states awarded to it as part of the 1911 Standard Oil antitrust settlement, it operated as Esso.[4] In other states, it operated as either Humble or Enco.[5] To create a unified brand going forward, it coined and adopted the Exxon mark.[6] In 1999, Exxon merged with Mobil Oil to form ExxonMobil.[7] Both the Exxon and the ExxonMobil marks in their characteristic colors and fonts are immediately recognizable today.

Not all of Exxon’s trademarks are so well known, however. Beginning in 1987, Exxon has also claimed trademark rights in the interlocking double Xs as a stand-alone mark for motor fuels and other products.[8] To support this claim, in January 2000, Exxon obtained a federal registration for the interlocking double X mark for gasoline.[9]

As a consumer of Exxon products for nearly forty years, I had never noticed the stand-alone double X mark, nor did I attribute any significance to the interlocking double Xs in the word Exxon. Nevertheless, if you look closely the next time you visit an Exxon service station, you may notice the mark. See if you can spot it in the photograph below.[10]

In addition to using and registering the interlocking double X mark, Exxon has also periodically enforced it. In terms of cases which have led to published opinions, Exxon unsuccessfully opposed the registration on the principal register of the trademark EXXELLO for commercial ice cream makers.[11] Exxon unsuccessfully asserted trademark infringement claims against the mark EXXENE for coatings and precoated plastic sheets applied to motorcycle and snowmobile windshields.[12] It also asserted state law dilution claims against the mark OXXFORD for men’s clothing.[13]

Our tale concerns two more recent cases. In October 2013, Exxon sued Fox Networks asserting trademark infringement and related claims over Fox’s FXX logo for a new television network. Like the Exxon logo, the FXX logo features interlocking double Xs. Compared to the double Xs in Exxon, however, the position of the two Xs in FXX is reversed, with the left X below and the right X above, as shown below:

For two years, from October 2013 until October 2015, the parties battled. Multiple experts, including myself, were hired.[14] Surveys were performed. Motions to dismiss, motions in limine, motions for summary judgment, and motions to exclude testimony were filed.[15] The district court issued opinions on two of the motions. It denied a motion to dismiss the state law dilution claims on preemption grounds, and it granted in part and denied in part a motion for summary judgment on Exxon’s claim to actual damages.[16] Just a few weeks before the scheduled trial, the parties settled.[17] Although the precise terms of the settlement are confidential, Fox Networks continues to use the interlocking double Xs in the logo for its FXX network.[18]

Just as the Fox Networks case finished up, the second case in our tale began. On October 27, 2015, Exxon sued Nielsen Spirits over Nielsen Spirits’s use of interlocking double Xs in its mark ROXX for vodka.[19]

On the merits, Exxon’s claims against Nielsen Spirits are very similar to its claims against Fox Networks.[20] While Exxon has registered the stand-alone double X mark, the double X mark does not have the strength or instant recognition among consumers that the Exxon mark has.[21] Other well-known companies have used and continue to use interlocking double Xs, including TJ Maxx.[22] The products at issue, whether gasoline and television networks, or gasoline and vodka, do not compete and are almost entirely unrelated.

Yet, there was a key difference in the two cases. Fox Networks had the resources to fight Exxon’s claims, but Nielsen Spirits did not. Because Nielson Spirits is only a small, two-person operation, the only motion it could afford to file was a motion to dismiss or alternatively, to transfer the litigation from Florida, where Exxon filed, to Arizona or California, where Nielsen Spirits did business.[23] The district judge did not rule on the motion, however, and less than a year later, in October 2016, the parties settled.[24] However, unlike the Exxon-Fox settlement, the terms of the Exxon-Nielsen Spirits settlement are not confidential. They are instead set forth, at least in part, in a consent judgment that the Florida district court entered. In the consent judgment, the court specifically ordered Nielsen Spirits to “cease any use of the Interlocking ROXX VODKA Logos, and any other mark that is confusingly similar to the Interlocking X Marks.”[25] Instead of interlocking double Xs, the consent judgment allowed Nielsen Spirits to use non-interlocking double Xs as shown below:

In the middle ages and even today in places other than the United States, it was, and is, not uncommon for the class or wealth of the respective parties to determine the outcome of a legal dispute. Today, we refer to this approach to dispute resolution as the rule of man because the rules depend upon the wealth, class, or status of the man for whom the rules are enforced and/or against whom the rules are applied.[26] The injustice of this approach to resolving disputes is readily apparent and has been well-known for centuries. Our modern system of dispute resolution is supposed to be based upon the rule of law. It does not, or at least should not, depend on the wealth or status of the respective parties. Rather, it should turn on the merits of the parties’ respective positions under universally applied legal rules. To reflect this, we depict Lady Justice as wearing a blindfold—not because justice is blind, but because justice does not and should not turn on the identity of the parties before her.

Yet, as our tale of two cases illustrates, outcomes today in the trademark system depend, and sometimes depend almost entirely, on the respective wealth of the parties. Fox Networks was able to continue using the interlocking double Xs in its FXX logo not because it had a stronger case under the applicable principles of trademark law than Nielsen Spirits. Rather, Fox Network was able to continue its use because it could afford to litigate, while Nielsen Spirits could not.

This is injustice of a very fundamental sort. Perversely, this injustice has arisen because judges, over the years, repeatedly sought to avoid injustice in the cases that came before them. At the turn of the twentieth century, trademark law consisted largely of a series of simple, black-and-white legal rules. Only inherently distinctive trademarks could receive protection as trademarks and only against the use of the same mark on the same product. Inevitably, these simple rules yielded outcomes that were unjust. When they did, judges would sometimes refuse to follow the rule and would replace a simple rule with a more open-ended standard. As judges continued to do this, in case after case over the years, they sharply increased the complexity, uncertainty, and expense associated with resolving trademark disputes. As a result, trademark law today has become a two-tiered system, in which resolution of disputes turns on a first and usually decisive question: Can you afford to litigate?

III. Trademarks and the Judicial Search for Perfect Justice: From Rules to Standards, From Simple to Complex

A. Judging Infringement: From Rule to Standard

Over the course of the twentieth century, courts changed trademark law’s scope of protection. What began as a specific rule for infringement became an open-ended standard. In the Trademark Acts of 1881 and 1905, Congress defined the scope of trademark protection using the so-called double-identity rule.[27] Under this rule, Congress limited protection to instances in which two conditions were satisfied. First, a plaintiff had to establish that a defendant had “reproduce[d], counterfeit[ed], cop[ied] or colorably imitate[d]” a registered mark.[28] In practice, this limited protection to a defendant’s use of either the same or a nearly identical mark. Second, a plaintiff further had to show that the defendant had used the same mark on “merchandise of substantially the same descriptive properties.”[29] In practice, this limited protection to a defendant’s use on the same goods. Thus, to demonstrate infringement, a plaintiff had to satisfy the double-identity rule. Under this rule, a defendant would infringe only by using: (1) the same mark (2) on the same goods.

Under this rule, using the same mark on a different product did not constitute trademark infringement. For example, in 1912, Borden’s Condensed Milk, which had long used Borden as the brand name for its condensed milk, sued another company that began using the name “Borden’s” for ice cream.[30] Although the district court granted relief, the Seventh Circuit reversed and rejected the claim.[31] The court held that because milk and ice cream were not competing products, there could be no unfair competition.[32] Recognizing that ice cream and milk did not share “the same descriptive properties,”[33] the plaintiff nevertheless argued that it should be entitled to relief for two reasons. First, it intended to enter the ice cream market.[34] Second, it was selling its condensed milk to ice cream manufacturers, and so the markets were close enough that some ice cream dealers would mistakenly believe that the plaintiff had made the defendant’s product.[35] The court rejected both arguments, however. With respect to the first, the court insisted that the law “deals with acts and not intentions.”[36] Because the defendant actually began selling ice cream under the Borden’s name first, the defendant held the rights to that name for ice cream.[37] The plaintiff’s intent to enter that market was simply irrelevant.[38] With respect to the second, the court said the specter of confusion was simply too “speculative and remote” to justify relief.[39]

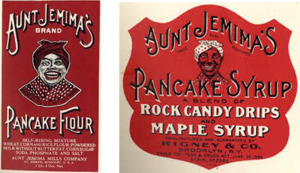

Just five years later, however, the Second Circuit embraced a different approach on a similar claim in Aunt Jemima Mills Co. v. Rigney & Co.[40] In this case, the plaintiff had used the phrase Aunt Jemima’s for self-rising pancake flour for years, when the defendant began using Aunt Jemima’s for syrup.[41] As the two goods did not have “the same descriptive properties,” the district court dismissed the complaint.[42] On appeal, the Second Circuit reversed.[43] Although the court acknowledged the traditional limits of trademark law, it nonetheless felt that the two products were sufficiently related that consumers were likely to believe that the plaintiff had made the defendant’s product.[44] It therefore granted relief and enjoined the defendant’s use.[45] As the court explained:

It is said that even a technical trade-mark may be appropriated by any one in any market for goods not in competition with those of the prior user. This was the view of the court below in saying that no one wanting syrup could possibly be made to take flour. But we think that goods, though different, may be so related as to fall within the mischief which equity should prevent. Syrup and flour are both food products, and food products commonly used together. Obviously, the public, or a large part of it, seeing this trade-mark on a syrup, would conclude that it was made by the complainant.[46]

To be sure, the Aunt Jemima case presented a fairly egregious set of facts. All of the selling power associated with the Aunt Jemima mark was the result of the plaintiff’s efforts; the Aunt Jemima mark had no intrinsic selling power.[47] Moreover, the defendant had intentionally duplicated not only the wordmark but also the iconic image of Aunt Jemima, as well as the color and style of the labeling, as shown below.

Although the Second Circuit in Aunt Jemima expanded trademark’s infringement standard to encompass use of the same mark on related goods, this expansion nevertheless retained trademark’s traditional focus on confusion as to source.[48] As the Aunt Jemima court itself found, syrup and self-rising flour were sufficiently related that “the public, or a large part of it, . . . would conclude that [the defendant’s product] was made by the complainant.”[49] Just seven years after Aunt Jemima, however, the Sixth Circuit expanded the infringement standard further yet and abandoned confusion as to source as a requirement for finding trademark infringement.[50] In Vogue Co. v. Thompson-Hudson Co., the plaintiff had long used the mark Vogue for its fashion magazine.[51] When the defendant thereafter adopted the mark Vogue for its hats, the plaintiff sued, alleging trademark infringement.[52] The district court dismissed the complaint on the grounds that no reasonable consumer would believe that Vogue magazine had begun manufacturing the defendant’s hats.[53] Although the Sixth Circuit agreed that such confusion as to source was unlikely, it nonetheless reversed.[54] In the Sixth Circuit’s view, the defendant’s use would likely lead consumers to believe that the plaintiff had sponsored or endorsed the defendant’s hats.[55] It held that such sponsorship confusion was sufficient to sustain the cause of action.[56] As the court explained:

Plaintiff’s magazine is so far an arbiter of style, and the use of plaintiff’s trade-mark upon defendants’ hats so far indicates that the hats were at least sponsored and approved by the plaintiff, that the same considerations which make the misrepresentation so valuable to defendants make it pregnant with peril to plaintiff.[57]

Again, the facts in the case were fairly egregious. The defendant had copied not only the Vogue wordmark but the V-girl mark, as shown below.

As the court acknowledged, the word “vogue” alone was neither arbitrary nor uniquely associated with Vogue magazine at the time.[58] Even then, “vogue” was “approximately synonymous with ‘style’ or ‘fashion.’”[59] Given its ordinary descriptive meaning, use of the wordmark might confuse some consumers, but the court refused to give relief on those grounds. Any confusion that might result from the use of the word “vogue” was the plaintiff’s own fault for picking, as its trademark, a word with a preexisting descriptive meaning—an approach that was fairly typical of the manner in which courts approached claims of unfair competition based upon use of a descriptive word at the time.[60]

With respect to the V-girl design, however, the court saw the matter differently. The large capital V, with or without the woman, “has been an individual characteristic of the plaintiff company in all its publications and advertisements in which it has used the word ‘Vogue.’”[61] While there were minor differences between the women depicted, in the court’s view, “the differences in the inclosed woman’s figure are immaterial, and only emphasize an obvious intent to leave a loophole of escape, while getting the full benefit of the copying.”[62]

As the twentieth century wore on, courts continued to expand the infringement standard. In 1955, the Second Circuit expanded the infringement standard to encompass confusion arising post-sale, among onlookers, rather than at the time of purchase by the purchaser.[63] In 1968, a federal district court expanded the infringement standard to encompass confusion as to affiliation or association, rather than confusion as to source or endorsement.[64] In 1975, the Second Circuit expanded the infringement standard to encompass initial interest confusion—confusion that initially attracts the attention of consumers to the defendant’s goods, even though it is dispelled before any actual purchase.[65] In the same year, the Fifth Circuit expanded the infringement standard to create a merchandising right for professional, and by extension, amateur sports teams.[66] It did so by holding that use of a sports team’s logo on merchandise, or as merchandise, inevitably led consumers to believe that the team had sponsored or approved the use.[67] In 1977, the Tenth Circuit expanded the infringement standard to encompass reverse confusion—confusion in which, rather than mistakenly believing that the plaintiff made the defendant’s goods, consumers mistakenly believe that the defendant made the plaintiff’s goods.[68]

As a result of this radical expansion of the infringement standard, it has become far more difficult to predict how a court will resolve any given trademark dispute. It has also become far more expensive to find out. Even in cases, such as our two Exxon cases, in which the likelihood of any actual confusion seems vanishingly small, a defendant has little chance of avoiding trial through a motion to dismiss or summary judgment motion. As the infringement standard expanded, all a plaintiff had to show was that a relatively small percentage, 10% or so, of consumers believed that the plaintiff had given permission for, or “‘[went] along’ with,”[69] the defendant’s use to establish a triable claim of infringement.

As the expansion took hold, cases of seeming injustice began to arise on the other side. Where the double identity rule created injustice by allowing unscrupulous defendants to cozy right up to the line, yet still evade infringement, the broader likelihood-of-confusion standard created injustice by allowing unscrupulous plaintiffs to assert claims that sought to limit fair competition, free speech, and other socially valued interests. As it did, courts created new trademark law in yet another misguided attempt to achieve justice in the cases before them.

B. Consequences of a Broad and Uncertain Standard for Infringement: The Resulting Need for Exceptions

As the expanded infringement standard began to take hold in the late twentieth century, courts adopted various strategies to limit the injustice the broader infringement standard that they had made up inevitably created. In some cases, courts pretended that factual differences between nearly identical cases justified differing outcomes. For example, the Boston Athletic Association pursued claims against both an unauthorized television broadcast of the Boston Marathon and unauthorized merchandise bearing the words “Boston Marathon.” Without any real evidentiary basis for distinguishing the two cases, the court found that consumers would infer sponsorship from the use of the words “Boston Marathon” on the unauthorized t-shirts but not on the television broadcast.[70] Similarly, and again without any real evidentiary basis, courts found that consumers would infer sponsorship for athletic team emblems and for vehicles made popular by television programs but not for the emblems of fraternal organizations.[71] In others, they simply refused to apply some of the more expansive forms of the infringement standard to particular cases—an approach courts continue to use today.[72]

Eventually, however, the overbroad and uncertain reach of the implied endorsement theory forced courts to limit its reach expressly, at least for particular defendants in particular situations. The Second Circuit was the first to adopt such an express limitation. In Rogers v. Grimaldi, Ginger Rogers sued the producers and distributors of a movie, Ginger and Fred.[73] As the court noted, the movie “only obliquely relates to Rogers and Astaire.”[74] Rather, than tell the story of Ginger Rogers and Fred Astaire, “[t]he film tells the story of two fictional Italian cabaret performers, Pippo and Amelia, who, in their heyday, imitated Rogers and Astaire and became known in Italy as ‘Ginger and Fred.’”[75] Rogers sued, alleging that the use of her name in the title would lead consumers to infer that she had endorsed the movie.[76] To support her claim, Rogers had a survey that showed that substantially more than the requisite 10% of consumers believed that Rogers was involved with making the film.[77] Ordinarily, such a survey would have been sufficient to create a triable issue on sponsorship or endorsement confusion. But the court refused to follow the ordinary approach.

Instead, the court held that trademark and unfair competition law would treat film titles differently.[78] To reach this conclusion, the court began with the undeniable point that films and movies are protected by the First Amendment’s free speech guarantees.[79] The court then took the small step from the film to its title: “Titles, like the artistic works they identify, are of a hybrid nature, combining artistic expression and commercial promotion.”[80] Because of that expressive character, titles “require[] more protection than the labeling of ordinary commercial products.”[81] In the court’s view, for titles, the public interest in avoiding consumer confusion must be balanced against the First Amendment interest in free expression.[82] Rather than allow an implication or inference of sponsorship from the mere use of a word, name, or trademark in a title, the court held that use of Roger’s name in the movie title would be actionable if and only if either: (1) the title had no artistic relevance to the film; or (2) the title expressly misleads as to source or sponsorship.[83] Finding neither to be the case, the court rejected Rogers’ claims as a matter of law.[84]

Three years later, the Ninth Circuit confronted a similar implied endorsement claim and created the so-called nominative fair use doctrine to narrow the reach for such claims.[85] In New Kids on the Block v. News America Publishing, the band, the New Kids on the Block, pursued claims against two newspapers that ran polls about the New Kids.[86] To respond to the polls, readers had to call 1-900 numbers, and for those calls, survey participants were charged.[87] The New Kids asserted an implied endorsement theory of confusion, alleging that consumers would believe that the New Kids had endorsed, sponsored, given permission, or merely went along with the polls.[88] Although the New Kids did not present a survey, under the implied endorsement theory of confusion, this was an entirely viable claim.

Yet, the Ninth Circuit rejected it as a matter of law.[89] While the district court, following the lead of the Rogers court, seized on the special protections afforded traditional press activities under the First Amendment to exonerate the defendants, the Ninth Circuit adopted a different approach.[90] Rather than relying on the First Amendment directly, or following the Second Circuit’s Rogers approach, the Ninth Circuit panel recognized a new defense or doctrine that it called nominative fair use.[91] In establishing this defense or doctrine, the panel began by identifying a trio of earlier cases in which courts had ruled in favor of defendants on implied endorsement theories.[92] In each of these three cases, the court had found a defendant, who admittedly used the plaintiff’s trademark without permission, not liable for trademark infringement.[93] In the first, an independent repair shop was allowed to advertise that it repaired Volkswagen vehicles, even though it was not authorized by or affiliated with Volkswagen.[94] In the second, a television station was allowed to label its unauthorized broadcast of the Boston Marathon as a broadcast of the Boston Marathon.[95] In the third, a competitor who made similar-smelling imitations of popular perfumes was allowed to advertise that its perfume smelled like Chanel No. 5.[96] These cases, in the New Kids court’s view, “are best understood as involving a non-trademark use of a mark—a use to which the infringement laws simply do not apply.”[97]

Had the Ninth Circuit stopped there, perhaps we could have developed a workable and general limitation on the scope of the implied endorsement theory. Unfortunately, the court did not stop there. Instead of relying on a non-trademark use rule, the New Kids court created a nominative fair use defense or doctrine. For the use to qualify as a non-infringing nominative use, the court identified three factors that must be present:

First, the product or service in question must be one not readily identifiable without use of the trademark; second, only so much of the mark or marks may be used as is reasonably necessary to identify the product or service; and third, the user must do nothing that would, in conjunction with the mark, suggest sponsorship or endorsement by the trademark holder.[98]

While the doctrine has a number of difficulties and ambiguities, perhaps the central difficulty is factor three: “the user must do nothing that would . . . suggest sponsorship.”[99] The central difficulty, of course, is that as the implied endorsement theory developed, it was the use of the mark alone that implied or suggested sponsorship or endorsement. To get around this, the court simply asserted that such implication or suggestion was not present in a nominative fair use case: “[S]uch use is fair because it does not imply sponsorship or endorsement by the trademark holder.”[100] The New Kids court offered no surveys or other evidence to support this factual assertion. Instead, the New Kids court cited Justice Holmes’s opinion in Prestonettes, Inc. v. Coty: “When the mark is used in a way that does not deceive the public we see no such sanctity in the word as to prevent its being used to tell the truth.”[101] Unfortunately, the Court’s statement in Prestonettes, Inc. does not support the proposition that the New Kids court is asserting. Justice Holmes was not addressing whether an implication or inference of sponsorship does or does not arise. Rather, Justice Holmes was stating that such implication or inference is irrelevant if the use of the word is accurate and in that sense, truthful.[102] As we saw in the Vogue hat case, if the use is accurate, any confusion that may result from a defendant’s use of a descriptive word is not the fault of the defendant, but of the plaintiff for picking a descriptive word as its trademark.[103] Thus, at the time he wrote the decision, Justice Holmes was not saying that there was no confusion. He was saying that so long as the use was truthful, any confusion that might result was not actionable.[104]

In any event, whatever the weaknesses in its reasoning, the New Kids court’s nominative fair use doctrine, along with the Rogers rule, might seem to re-instill some rule-like clarity into trademark law. Unfortunately, that has not proven to be the case. The other circuits have not all embraced these doctrines, and when they have, they have not adopted identical interpretations.[105] Beyond movie titles, the reach of the Rogers rule remains unclear. With respect to the nominative fair use doctrine, the doctrine, by its express terms, includes considerable uncertainty as to how much use goes beyond what is reasonably necessary and exactly what, beyond mere use of the mark itself, constitutes “doing something” to suggest sponsorship or endorsement. Rather than simplify the issue, the availability of these, and other similar defenses, has also increased the cost and uncertainty of trademark litigation for the vast majority of litigants.[106]

IV. Trademark Law: A New Wrinkle on the Rules-Standards Debate

Over the course of the twentieth century, the scope of trademark protection evolved from a set of narrow and quite specific legal rules into a broad and general standard of infringement—counterbalanced to some extent by judicial creation of limitations and exceptions for specific uses by specific defendants in specific cases. At a broad level, we can characterize this evolution as one from a set of rules that defined the scope of trademark protection to a set of standards. Put in those terms, the trade-offs between rules and standards are well-known and have been extensively explored. Rules are certain and consistent, entail less judicial discretion, and are less expensive to administer but have potentially higher error costs.[107] Standards are less certain and less consistent, entail more judicial discretion, and are more expensive to administer but have, at least in theory, lower error costs.[108]

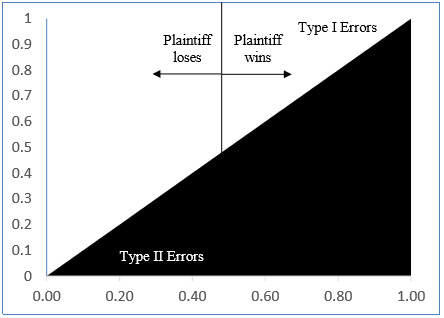

We can illustrate parts of this trade-off using a graphical depiction of all possible trademark cases. Along the horizontal axis, we chart the cumulative percentage of the distribution of potential trademark disputes from 0% to 100%. On the vertical axis, we have the percentage chance that enjoining the conduct will increase social welfare (or whatever measure of justice you would like to use). Figure 1 depicts the result.

At each end of Figure 1, we have paradigmatic cases of fair and unfair competition. Thus, on the far-left end of the distribution, we have the paradigmatic case of fair competition. Such a case would include, for example, instances in which competitors are using different trademarks, such as Coke and Pepsi, for the same cola product.[109] For such a

paradigmatic case of fair competition, there is no chance that prohibiting the selling of Pepsi Cola would increase social welfare. It would merely reduce competition without materially reducing consumer confusion in the marketplace. While it would undoubtedly increase Coca-Cola’s revenue and profit to prohibit such fair competition, doing so would impose a larger welfare loss on consumers. It would, therefore, lead to a net reduction in social welfare. For that reason, there is a 0% chance that enjoining the sale of Pepsi Cola would increase social welfare. For cases at this end of the spectrum, as Figure 1 reflects, there is a 0% chance that the plaintiff should prevail.

On the far-right end of the distribution, we have the paradigmatic case of unfair competition. Such a case would include, for example, classic instances of true counterfeiting. “True” counterfeiting includes only those cases in which the consumer pays full price and believes that he or she is buying the authentic good but is unknowingly getting an inferior imitation instead.[110] Defined in this way, true counterfeiting, because it involves actual deception, almost necessarily reduces social welfare. For cases at this end of the spectrum, there is a 100% chance that the plaintiff should prevail.

At each end, for the paradigmatic cases of either fair or unfair competition, a fully informed welfare analysis suggests that a plaintiff should have either a 0 or a 100% chance of prevailing. In between these two paradigmatic cases, we have a range of disputes. As we move from the left end to the right, we move towards cases where the competition is increasingly unfair. The lower black triangle depicts those cases where a fully informed welfare analysis establishes that a plaintiff should prevail. The upper white triangle, on the other hand, depicts those cases where a fully informed welfare analysis establishes that a plaintiff should lose. As we move from the paradigmatic case of fair competition to the paradigmatic case of unfair competition, the chance that a plaintiff should prevail rises steadily, and, in linear fashion,[111] from 0% to 100%.

Figure 1 assumes that we have limited information and thus cannot conduct a fully informed welfare analysis for each individual case. Thus, a government regulator may know the distribution of potential disputes (along the X-axis) but have no ability to differentiate between the cases at any given point along the distribution where enjoining the defendant’s conduct will increase social welfare from those where it will reduce social welfare (in other words, where a case falls on the Y-axis). With limited information, the best the regulator can do is to group alike cases together; she cannot, however, separate those similar cases into ones in which enjoining the defendant’s conduct at issue would increase social welfare from those in which enjoining the defendant’s conduct would reduce social welfare. Thus, the regulator can determine that a case falls at the fiftieth percentile along the x-axis. The regulator cannot determine, however, whether the particular case at issue falls within the 50% of cases at that point where a fully informed social welfare analysis would establish that enjoining the conduct is desirable or the 50% of cases at that point where a fully informed social welfare analysis would establish that enjoining the conduct is undesirable. Given these assumptions, the optimal approach for the regulator would be to adopt a rule that falls in the middle. The rule would declare as unfair all cases to the right of the rule in the distribution of cases and declare as fair all cases falling to the left of the rule in the distribution of cases. Figure 2 illustrates such an approach.

While drawing a line in the middle may seem simplistic, as Figure 2 illustrates, under our assumptions, it reaches the right outcome 75% of the time. In the other 25%, the legal system reaches the wrong outcome. These mistakes are divided evenly between: (a) Type I errors in which a plaintiff wins under the rule, but a fully informed social welfare analysis establishes that the plaintiff should lose; and (b) Type II errors in which a plaintiff loses under the rule, but a fully informed social welfare analysis establishes that the plaintiff should win.

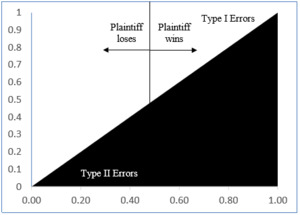

The perceived advantage of a standards-based approach is that it can reduce this error rate. In theory, if we can devise a standard that perfectly matches the outcome of a fully informed welfare analysis, a standards-based approach can reach the right outcome in every case. The error rate, whether of Type I or Type II errors, drops to zero. Figure 3 illustrates this theoretical possibility.

For the ideal standard depicted in Figure 3, there is no separate line for the legal standard used to resolve trademark disputes. Rather, it maps exactly on the line between the black and white triangles. This is the same line that precisely separates those cases in which a fully informed social welfare analysis establishes that a plaintiff should lose from those in which such an analysis establishes that a plaintiff should win. Under such an ideal standard, the standards-based approach resolves every case correctly. The error rate falls to zero.

Of course, given current technology and inevitable human fallibility, such an approach remains only a theoretical ideal. Nevertheless, to the extent that a standards-based approach can reduce the error rate compared with a rules-based approach, it becomes, in the traditional analysis, a question of balancing the welfare gains from reducing the error rate against the increased costs, primarily administrative, of the standards-based approach.

In trademark law, the shift from simple rules to complex and uncertain standards that we have seen over the last hundred years has sharply increased the administrative costs associated with litigating a trademark dispute.[112] For the parties themselves, the AIPLA estimated in 2015 that a party will spend, on average, $325,000 through trial in trademark litigation if the amount in controversy in the litigation is less than $1,000,000.[113] As the amount in controversy increases, the average cost increases as well. When the value of the disputed mark exceeds $25,000,000, the average cost to each party increases to $1,600,000 million.[114] For many small businesses, even the lower of these two amounts likely remains beyond their reach.

In trademark disputes, the amount in controversy turns on the value of the disputed mark.[115] Damages are seldom awarded in trademark litigation.[116] Usually what is at stake is whether a defendant may continue to use the trademark at issue or must cease. As a result, the amount in controversy is usually the net present value of the expected marginal rents a party will capture if it prevails. If the plaintiff prevails, the defendant will have to cease competing unfairly. The plaintiff will, therefore, capture additional sales and may have a higher profit margin. If the plaintiff loses, the defendant will get to continue competing. In either case, the prevailing party will capture some, perhaps considerable, additional rents. These additional rents are, in the usual claim of trademark infringement, the amount in controversy in the litigation.

For a profit-maximizing plaintiff, and ignoring reputational, repeat-player concerns, the plaintiff will sue a defendant for trademark infringement if:

Vp=RSp–C>0 (1)

In equation (1), Vp is the net value of pursuing litigation to the plaintiff, R is the plaintiff’s chance of success, Sp is the net present value of the expected additional rents or surplus that the plaintiff will earn if it prevails, and C is the cost of the litigation. So long as Vp is greater than zero, a rational, profit-maximizing plaintiff will sue.

Similarly, for a profit-maximizing defendant and again, ignoring reputational, repeat-player concerns, the defendant will engage in litigation to defend its right to use a trademark if:

Vd=(1–R)Sd–C>0 (2)

In equation (2), Vd is the net value of pursuing litigation to the defendant, (1-R) is the defendant’s chance of success, Sd is the net present value of the expected additional rents or surplus that the defendant will earn if it prevails, and C is the cost of the litigation.[117] So long as Vd is greater than zero, a rational, profit-maximizing defendant will fight, rather than concede.

Switching from rules to standards changes two key variables in these equations. First, it introduces uncertainty into the plaintiff’s chance of success. With a rule, R will often be either one or zero, and which one it is will usually be plain to both parties from the outset. Thus, if we had retained the double identity rule for infringement, the chance that Exxon could succeed on its claims that Roxx vodka infringed its interlocking double X trademark for gasoline would be essentially zero. Vodka does not compete with gasoline or other petrochemical products. If Exxon threatened to sue Nielsen Spirits over Roxx vodka, both sides would know it was an empty threat under the double-identity rule. However, because courts have replaced the double-identity rule with the likelihood-of-confusion standard, Exxon has some chance of success. It might be a relatively small chance of success, to the extent that Exxon’s claims are relatively weak even under the likelihood-of-confusion standard, but Exxon’s chance of success is no longer zero.

Second, the switch from rules to standards also radically increases the cost of testing a plaintiff’s claim of infringement. Again, using the Roxx vodka example, if we had retained the double identity rule for infringement, a simple, and relatively inexpensive motion to dismiss would have been sufficient to resolve the case. In contrast, under today’s standards for the likelihood of confusion or dilution, there was no simple and inexpensive path to judicial resolution. Perhaps, Nielsen Spirits could prevail on a summary judgment motion, but even that would require Nielsen Spirits to cover the substantial expenses associated with discovery.[118] Even after discovery though, there is no guarantee that the court would grant the summary judgment motion. With the resources at its disposal, Exxon can hire experts and perform repeated surveys. With sufficient resources, sooner or later, one of those surveys will yield results sufficient to create a genuine dispute as to whether the interlocking double Xs in Roxx created a likelihood of confusion or a likelihood of dilution with respect to Exxon’s interlocking double X mark. Had the parties not settled, the case might well have gone to trial.

If we take $400,000 as the costs of defense for Nielsen Spirits and estimate that Exxon has only a 25% chance of success, then under equation (2), the net present value of the expected rents, Sd, from continuing to use the interlocking double Xs in Roxx vodka must be at least $500,000 to justify Nielsen Spirits defending against Exxon’s claims. Keep in mind that the $500,000 net present value must reflect both: (1) rents, not revenue, from continued use of the mark and (2) marginal, additional rents from using Roxx with the interlocking double Xs over and above the rents from using a non-infringing version of Roxx.

Moreover, even if Nielsen Spirits expected to capture surplus, Sd, in excess of $500,000, and could justify defending itself, Exxon’s ability to threaten or begin litigation sharply reduces the amount Exxon will have to pay Nielsen Spirits to persuade Nielsen Spirits to switch to a non-infringing alternative. For example, assume that Nielsen Spirits estimates that it will capture $1 million in surplus, Sd, from continuing to use the Roxx mark with the interlocking double Xs, over and above the net present value of rents it would capture with a non-infringing version of Roxx. In the absence of a threat of litigation, Nielsen Spirits would willingly “sell” its right to use the Roxx mark with interlocking Xs to Exxon for any sum in excess of $1 million. However, this price drops sharply if Exxon can plausibly threaten suit. With an expected defense cost of $400,000 and an 80% chance of prevailing, the value to Nielsen Spirits of litigating in equation (2) is positive, specifically $400,000. So, Nielsen Spirits would be prepared to defend its rights. Nevertheless, under these assumptions, Nielsen Spirits would be willing to settle and give up its right to continue using Roxx with the interlocking Xs if Exxon were to offer Nielsen Spirits more than the $400,000 as compensation for switching to a non-infringing alternative. The greater ability to threaten suit under today’s standards-based trademark law sharply reduces—by 60%—the amount Exxon has to pay to persuade Nielsen Spirits to switch.[119]

Thus, the judicial switch from relatively simple rules to more complex, open-ended standards in trademark laws imposes two forms of injustice on potential trademark parties. First, the high administrative cost and uncertainty associated with resolving disputes through today’s more complex, standards-based trademark system mean many small businesses cannot afford to participate in the system at all. When their use of a particular mark is challenged or their attempt to register their own mark is opposed, the only path they can afford is to concede. Second, for the somewhat larger, mid-sized businesses, who can potentially afford litigation, the high administrative cost and uncertainty put them in a situation in which it is nevertheless rational to compromise and sell their rights at a discount.

As a result, rather than achieve the optimal justice Figure 3 depicts, using standards to resolve trademark disputes creates a two-tiered system. When a wealthy firm confronts another wealthy firm, and both can afford to litigate, the system produces reasonably sensible outcomes. However, when a wealthy firm confronts a firm that cannot afford to litigate, the wealthy firm automatically wins. Instead of the optimal justice Figure 3 depicts, using standards to resolve trademark disputes in the lower tier produces injustice. In the lower tier, where the wealthy party is the plaintiff, as in the Roxx vodka dispute, the trademark system produces results that favor the plaintiff almost without regard to the underlying merits of the claim. Figure 4 illustrates one possible distribution of results for wealthy plaintiff, poor defendant cases in our more expensive and uncertain standards-based trademark system.[120]

As compared to the optimal justice of a standards-based approach that Figure 3 depicts, the justice that a standards-based approach achieves in Figure 4 is far less optimal. Rather than an error rate of zero, as in the optimal case, or even the error rate of 25% under a simple rules-based approach, the error rate in Figure 4 increases to 32%. All of the errors become Type I. In 32% of the potential trademark cases, plaintiffs that should lose under a fully informed social welfare analysis will nevertheless prevail because they are better able to afford litigation.

When the plaintiff is poor and the defendant wealthy, on the other hand, the trademark system produces results that favor the defendant, again almost without regard to the underlying merits of the defendant’s position.[121] Figure 5 illustrates one possible distribution of results in poor-plaintiff, wealthy-defendant cases in our more expensive and uncertain standards-based trademark system.[122]

As in Figure 4, the justice Figure 5 depicts is once again less than optimal. Rather than the zero error rate of Figure 3 or even the 25% error rate of a simple rules-based approach, the error rate is once again 32%. In this situation, however, all errors are Type II. In 32% of the potential trademark disputes, a plaintiff that should prevail under a fully informed welfare analysis will nevertheless lose because they are less able to afford the costs of litigation.

V. Achieving Justice for Most in Trademark Law

The increasingly complex trademark law that courts have created may yield more perfect justice for the increasingly small number of businesses that can afford to participate in it. But that more perfect trademark justice for the very few comes at the cost of no trademark justice at all for the many. A solution will not be easy, however. While there are a number of approaches that might help address this issue, including fee shifting[123] or a more extensive laundry list of defenses,[124] my preferred solution involves two steps. First, we need to return to a system of simpler rules, including the double identity rule for infringement, in trademark law. Second, we should rely more on the federal registration process as a less expensive alternative to litigation to resolve trademark disputes.[125]

With respect to the first suggestion, compared to the simpler rule of double identity, today’s far more complex likelihood-of-confusion standard generates little welfare gain even when both parties can afford to litigate. Even in the most sympathetic case for expanding protection beyond the double-identity rule, such as the Aunt Jemima case, the welfare gains from expanding protection are trivial, if not entirely imaginary. Had the defendant offered the same mark on the same product, consumers would be unable to distinguish the two products. As a result, they would necessarily associate any dissatisfaction with the defendant’s product with the plaintiff. In contrast, when the products are different, consumers can readily separate the two. If they like the syrup, they can continue to buy it. If not, then they will not. But as marketing research has shown, there is no evidence that their satisfaction or dissatisfaction with the defendant’s syrup will influence consumers’ decisions to buy or not buy the plaintiff’s pancake mix.[126]

I recognize the perception of unfairness that the defendant’s free riding in the Aunt Jemima case generates. Yet, at the same time, consumers can more readily adapt to and mitigate the social costs of narrow trademark protection. They can simply refuse to extend positive associations from one branded product to other goods with a similar name. If they make a mistake and do so from time to time, that mistake would impose only a one-time social cost. In contrast, as trademark protection has expanded and become more complex, brands have become their own markets.[127] For would-be entrants, alternative brand designations have become difficult to find.[128] These lead inevitably to higher prices and reduced choice for consumers. In the face of these social costs, consumers have no choice but to pay.

Moreover, even if we assume arguendo that trademark’s more complicated standards generate some welfare gains in some cases, the price of excluding wholesale, smaller entities and new entrants from the trademark system has become too high a price to pay.

With respect to the second suggestion, the trademark registration process is not a full substitute for trademark infringement and unfair competition litigation, but it can often serve as a less expensive alternative.[129] Until recently, the ability to register a trademark on the principal register and to use the mark in commerce were entirely separate issues. Whether an entity could or could not register a mark had no or very little effect on whether the entity could use the mark in trade. However, in its 2015 B & B Hardware, Inc. v. Hargis Industries, Inc. decision, the Court sharply narrowed this separation.[130]

In B & B Hardware, the Court held that the Trademark Trial and Appeal Board (TTAB) resolution of opposition proceedings over the federal registration of a mark could have preclusive effect in subsequent trademark litigation.[131] The case concerned two parties, B & B Hardware and Hargis Industries, that used similar marks for similar products. Hargis Industries used the mark “Sealtite,” and B & B Hardware used the mark “Sealtight,” both for metal fasteners.[132] The parties’ dispute over their respective trademark rights had been going on for years.[133] When Hargis Industries attempted to register its mark federally, B & B Hardware persuaded the TTAB that the marks were confusingly similar and successfully opposed the registration.[134] This did not stop Hargis Industries’ actual use of the mark, however.[135] To do that, B & B Hardware initiated separate trademark and unfair competition litigation in federal district court in Arkansas.[136] As in the TTAB proceeding, the central issue in the infringement litigation was whether Hargis Industries’ use created a likelihood of confusion.[137] To avoid an expensive trial on the issue, B & B Hardware argued that the district court should give the TTAB decision preclusive effect.[138] But the Arkansas district court refused. It reasoned that issue preclusion did not apply because: (1) the TTAB was an administrative tribunal, not an Article III court, and (2) there were some nontrivial differences in the likelihood-of-confusion standards the two decision-makers applied.[139] So instead of following the TTAB’s lead, the court re-tried the issue whether Hargis Industries’ mark created a likelihood of confusion to a jury, and the jury concluded that there was no likelihood of confusion.[140] On appeal, the Eighth Circuit affirmed.[141]

The Supreme Court, however, reversed.[142] Although the Court did not rule that a TTAB decision on the likelihood-of-confusion issue in the registration context would always have preclusive effect, the Court decisively rejected the various rationales the Eighth Circuit had offered for refusing to follow the TTAB’s lead.[143] Neither the TTAB’s status as an administrative agency rather than an Article III court, nor the minor differences in the factor tests the TTAB applied to determine the likelihood of confusion were sufficient to foreclose issue preclusion.[144] While the Court recognized that issue preclusion might not apply if the applicant sought to register a different mark for different goods than those at issue in the infringement litigation, the Court held that “[s]o long as the other ordinary elements of issue preclusion are met, when the usages adjudicated by the TTAB are materially the same as those before the district court, issue preclusion should apply.”[145]

By giving TTAB resolutions broader preclusive effect, the Court has opened up a less expensive and quicker path for resolution of trademark disputes. Instead of litigating likelihood of confusion through a far more expensive district court infringement proceeding, parties can use the registration and opposition process to resolve the issue. To be sure, it is not a perfect alternative for, at least, three reasons. First, the standards for registration that the TTAB applies have been infected by the same undue complexity that the courts created for litigation.[146] Second, in resolving oppositions, the TTAB applies an inappropriate rule of “doubt” that preferences existing businesses over new entrants.[147] Third, the court charged with appellate jurisdiction over the TTAB, the Federal Circuit and its predecessor, the Court of Customs and Patent Appeals, has demonstrated a strong pro-trademark owner, anti-consumer bias in its decisions over the years.[148]

In the end, however, it is a choice of imperfections. Even if the law governing trademark registration follows the same unnecessarily complex standards the courts made up for trademark litigation, using the less expensive registration process and its associated dispute resolution mechanisms still offer a wider range of entities access to the system.[149] While B & B Hardware makes this alternative a viable choice for a wider range of disputes, we could certainly take steps to encourage parties to pursue the registration alternative. We could, for example, require proof of additional elements, impose heightened pleading standards, or establish a higher burden of proof to establish infringement of trademarks that a party has chosen not to register, as Professor Rebecca Tushnet has suggested.[150]

In addition to these two suggestions, I also offer this advice to judges. Even if you think you know how to resolve the case in front of you, take a step back before you start rewriting the rules. Even if you are right about the case in front of you, you have no idea where your decision may lead in the future or even how it would apply to the full range of potential trademark cases in the present. Stop trying to do justice; start following the law.

There is a lower tier where neither party can afford to litigate. While a full discussion of this tier is beyond the scope of this Article, in my experience, parties in this tier engage in elaborate bluffs and counterbluffs. Obtaining a corporate name registration from a state secretary of state is usually taken as conclusive evidence that a name complies with trademark law.

While it may sometimes be the case that an ability to afford litigation provides some evidence of the economic value of a given position, that is not generally the case in trademark law. With imperfect markets for financing litigation, all that a better ability to afford litigation usually indicates is which party is established and which party is a new entrant.

Exxon Corp. v. Tex. Motor Exch. of Hous., Inc., 628 F.2d 500, 502 (5th Cir. 1980).

Exxon Corp. v. Exxene Corp., 696 F.2d 544, 546 (7th Cir. 1982).

Id.

Id. at 546–47.

Exxon-Mobil Merger Done, CNNMoney (Nov. 30, 1999, 5:10 PM), http://money.cnn.com/1999/11/30/deals/exxonmobil [http://perma.cc/TUZ9-F99T].

Consent Final Judgment at 2, Exxon Mobil Corp. v. Nielsen Spirits, Inc., No.

15-24022 (S.D. Fla. Nov. 8, 2016).XX, Registration No. 2,305,494.

See, e.g., Complaint at 5, Exxon Mobil Corp. v. Nielsen Spirits, Inc., No.

1:15-CV-24022 (S.D. Fla. Oct. 27, 2015); Amended Complaint at 4, Exxon Mobil Corp. v. FX Networks, LLC, No. 4:13-CV-02906 (S.D. Tex. Dec. 12, 2013) (showing picture in each complaint to demonstrate context of XX mark).Exxon Corp. v. Nat’l Foodline Corp., 579 F.2d 1244, 1245 (C.C.P.A. 1978).

Exxon Corp. v. Exxene Corp., 696 F.2d 544, 546–47, 551 (7th Cir. 1982).

Exxon Corp. v. Oxxford Clothes, Inc., 109 F.3d 1070, 1073 (5th Cir. 1997). The mark OXXFORD without interlocking Xs remains federally registered. OXXFORD, Registration No. 510,041.

I was hired by Fox Networks to examine Exxon’s enforcement activity with respect to the interlocking double X mark. The Westlaw filings for the case include expert reports by Professor Ravi Dahr, Dr. Itamar Simonson, and Dr. David Stewart that were filed in connection with a motion to exclude. See Expert Report of Professor Ravi Dhar, Exxon Mobil Corp. v. FX Networks, LLC, No. 4:13-CV-02906 (S.D. Tex. June 2, 2015); Expert Report of Dr. Imitar Simonson, FX Networks, LLC, No. 4:13-CV-02906 (May 29, 2015); Expert Report of David Stewart, Ph.D., A Likelihood of Confusion Survey in the Matter of Exxon Mobil Corp. v. FX Networks, LLC, et al., FX Networks, LLC, No. 4:13-CV-02906 (Apr. 28, 2015).

The Westlaw filings for the case include:

(i) Defendants’ Motion to Exclude Portions of the Expert Report of Dr. Robert Frank and Related Testimony and Memorandum in Support, FX Networks, LLC, No. 4:13-CV-02906 (July 14, 2015);

(ii) Defendants’ Motion in Limine to Exclude Anonymous Internet Blog Postings and Memorandum in Support, FX Networks, LLC, No. 4:13-CV-02906 (July 14, 2015);

(iii) Defendants’ Motion to Exclude Evidence Resulting in an Adverse Inference Regarding FX’s Invocation of the Attorney-Client Privilege and Memorandum in Support, FX Networks, LLC, No. 4:13-CV-02906 (July 14, 2015);

(iv) Plaintiff’s Motion to Exclude Portions of Ravi Dahr’s Expert Report and Testimony, FX Networks, LLC, No. 4:13-CV-02906 (July 14, 2015);

(v) Defendants’ Consolidated Motion to Exclude the Expert Reports and Testimony of Dr. David Stewart and Dr. James Pomerantz and Memorandum in Support, FX Networks, LLC, No. 4:13-CV-02906 (July 14, 2015); and

(vi) Defendants’ Rule 12(b)(6) Motion to Dismiss Count V of Plaintiff’s Amended Complaint, FX Networks, LLC, No. 4:13-CV-02906 (Dec. 26, 2013).

Exxon Mobil Corp. v. FX Networks, LLC, 39 F. Supp. 3d 868, 871–72 (S.D. Tex. 2014) (holding that Exxon’s state law dilution claims were not preempted by Lanham Act Section 43(c)(6)); Exxon Mobil Corp. v. FX Networks, LLC, No. H-13-2906, 2015 WL 12942049, at *1 (S.D. Tex. Aug. 26, 2015) (granting in part and denying in part the Defendants’ motion to dismiss Exxon’s claim for actual damages).

Eriq Gardner, Fox, ExxonMobil Hit Brakes on “FXX” Trademark Dispute, Hollywood Rep. (Oct. 19, 2015, 3:10 PM), https://www.hollywoodreporter.com/thr-esq/fox-exxonmobil-hit-brakes-fxx-833113 [http://perma.cc/SH6W-7FSS] (last visited Nov. 2, 2018).

See Laurel Brubaker Calkins, Exxon Mobil Settles Logo Trademark Fight with FXX Network, 90 Pat., Trademark & Copyright J. 3547, 3565 (2015); FXX Schedule, FX, http://www.fxnetworks.com/fxx [http://perma.cc/EP5T-GPVX] (last visited Nov. 2, 2018).

Complaint at 10–11, Exxon Mobil Corp. v. Nielsen Spirits, Inc., No. 1:15-CV-24022 (S.D. Fla. Oct. 27, 2015).

Compare id. at 10–13 (alleging federal trademark infringement, violation of Lanham Act Section 43(a), federal trademark dilution, Florida common law unfair competition, dilution under Florida state law, unjust enrichment, and refusal of registration), with Amended Complaint at 10–13, Exxon Mobil Corp. v. FX Networks, LLC, No. 4:13-CV-02906 (S.D. Tex. Dec. 12, 2013) (alleging infringement of registered marks, violation of Lanham Act Section 43(a), federal trademark dilution, common law unfair competition, dilution under Texas law, unjust enrichment, and refusal of registration).

XX, Registration No. 2,305,494; see Expert Report of Professor Ravi Dhar, supra note 14, at 7–8.

See, e.g., T.J. MAXX, Registration No. 1,495,462.

Motion to Dismiss or in the Alternative Transfer of Venue for Forum Non Conveniens for Specially Appearing Defendants Pursuant to Federal Rules of Civil Procedure 12(b)(2) and 12(b)(3) and Supporting Memorandum of Points and Authorities at 8–9, 16–17, Nielson Spirits, Inc., No. 1:15-CV-24022 (Dec. 10, 2015).

Consent Final Judgment at 7, Nielson Spirits, Inc., No. 1:15-CV-24022 (Nov. 8, 2016).

Id. at 6.

See Rene Valladares, The Rule of Law vs. The Rule of Man, 26 Nev. Law. 36, 36 (2018) (comparing the legal system of Nicaragua where dictators used the legal system to punish whomever they saw fit to punish with the United States). Some scholars use the phrase “rule of man” to refer to the discretion inherent in the application of any set of rules or standards within a rule of law framework, but I am not using that watered-down version of the concept here. See, e.g., Dean J. Spader, Rule of Law v. Rule of Man: The Search for the Golden Zigzag Between Conflicting Fundamental Values, 12 J. Crim. Just. 379 (1984) (laying out an analysis of the conflict between law and discretion).

In the relevant provisions, the Acts provide:

Any person who shall reproduce, counterfeit, copy or colorably imitate any trade-mark registered under this act and affix the same to merchandise of substantially the same descriptive properties as those described in the registration, shall be liable to an action on the case for damages for the wrongful use of said trade-mark . . . .

Act of Mar. 3, 1881, ch. 138, § 7, 21 Stat. 502, 503–04; see also Act of Feb. 20, 1905, ch. 592, § 16, 33 Stat. 724, 728 (containing similar language).

§ 7, 21 Stat. at 503.

Id.

Borden’s Condensed Milk Co. v. Borden Ice Cream Co., 194 F. 554, 554–55 (N.D. Ill. 1912).

Borden Ice Cream Co. v. Borden’s Condensed Milk Co., 201 F. 510, 515 (7th Cir. 1912).

Id. at 514.

§ 7, 21 Stat. at 503.

Borden, 201 F. at 514–15.

Id. at 515.

Id. (quoting George v. Smith, 52 F. 830, 832 (C.C.S.D.N.Y. 1892)).

Id.

Id.

Id.

Aunt Jemima Mills Co. v. Rigney & Co., 247 F. 407 (2d Cir. 1917).

Aunt Jemima Mills Co. v. Rigney & Co., 234 F. 804, 805 (E.D.N.Y. 1916), rev’d, 247 F. 407 (2d Cir. 1917).

Id.

Aunt Jemima Mills, 247 F. at 412.

Id. at 409–10.

Id. at 412.

Id. at 409–10.

Matt Soniak, How Aunt Jemima Changed U.S. Trademark Law, Mental Floss (June 15, 2012), http://mentalfloss.com/article/30933/how-aunt-jemima-changed-us-trademark-law [http://perma.cc/44KH-7UJE].

One of the participants at the Santa Fe conference has suggested to me that Rigney & Co.'s behavior was actionable under passing off or unfair competition, even if the court had not expanded trademark’s infringement standard. This is incorrect. As the Borden’s case illustrates, at the time, actionable unfair competition required competition. See Borden Ice Cream Co. v. Borden’s Condensed Milk Co., 201 F. 510, 513 (7th Cir. 1912). Syrup and flour are complements, not substitutes. They do not compete.

Aunt Jemima Mills, 247 F. at 409–10 (“Obviously the public, or a large part of it, seeing this trade-mark on a syrup, would conclude that it was made by the complainant.”).

Vogue Co. v. Thompson-Hudson Co., 300 F. 509, 512 (6th Cir. 1924).

Id. at 509–10.

Id. at 510.

Id. (“The District Court thought that, so far as the case counted on unfair competition, it must be dismissed, because there was no competition between the publishing of the magazine and the manufacture of hats, and that, so far as it counted on trade-mark infringement, it failed, because magazines and hats are not articles ‘of the same descriptive qualities.’”).

Id. at 511–12.

Id. at 511.

Id. at 511–12.

Id. at 512.

Id. at 511.

Id.

As the court explained:

The record informs us that ‘Vogue Shops,’ selling various kinds of apparel, have been and are very common throughout the country. Plaintiff’s claim of monopoly along this line logically embraces them all; and though, particularly as to women’s apparel, there is likely to be a considerable element of mistake on the part of purchasers who suppose that the use of the word indicates some connection with the magazine, it is a mistake for which plaintiff must carry the responsibility, because it chose as the name of its magazine a word which all are at liberty to use.

Id.

Id.

Id.

Mastercrafters Clock & Radio Co. v. Vacheron & Constantin-LeCoultre Watches, Inc., 221 F.2d 464, 466 (2d Cir. 1955); see also Ferrari S.P.A. v. Roberts, 944 F.2d 1235, 1245–46 (6th Cir. 1991) (holding the cars intended to mimic appearance of Ferraris infringed upon Ferrari’s trade dress in its cars even though purchasers not confused); Rolex Watch U.S.A., Inc. v. Canner, 645 F. Supp. 484, 492–93 (S.D. Fla. 1986) (holding that sale of low-priced imitation Rolex watches constituted trademark infringement even though purchasers were not confused).

Carling Brewing Co. v. Philip Morris Inc., 297 F. Supp. 1330, 1337–38 (N.D. Ga. 1968). In an attempt to justify the expansion, the court explained:

Given the general situation where the public is generally unaware of the specific corporate structure of those whose products it buys, but is aware that corporate diversification, mergers, acquisitions and operation through subsidiaries is a fact of life, it is reasonable to believe that the appearance of “Black Label” on cigarettes could lead to some confusion as to the sponsorship of EITHER or both the cigarettes and the beer. Whether the public concludes (if it really draws a specific conclusion) that plaintiff’s Black Label beer may have become connected with Philip Morris, or that Carling may now be putting out cigarettes is immaterial.

Id. at 1337.

Grotrian, Helfferich, Schulz, Th. Steinweg Nachf. v. Steinway & Sons, 523 F.2d 1331, 1341–42 (2d Cir. 1975).

Bos. Prof’l Hockey Ass’n v. Dall. Cap & Emblem Mfg., Inc., 510 F.2d 1004, 1012 (5th Cir. 1975); see also Warner Bros., Inc. v. Gay Toys, Inc., 658 F.2d 76, 79 (2d Cir. 1981) (recognizing a similar merchandising right for popular television shows). But see Int’l Order of Job’s Daughters v. Lindeburg & Co., 633 F.2d 912, 920 (9th Cir. 1980) (rejecting merchandising right for fraternal organization).

Bos. Prof’l Hockey Ass’n, 510 F.2d at 1012 (“The confusion or deceit requirement is met by the fact that the defendant duplicated the protected trademarks and sold them to the public knowing that the public would identify them as being the teams’ trademarks. The certain knowledge of the buyer that the source and origin of the trademark symbols were in plaintiffs satisfies the requirement of the act.”); see also Ky. Fried Chicken Corp. v. Diversified Packaging Corp., 549 F.2d 368, 389 (5th Cir. 1977) (“Boston Hockey also reiterated our unbroken insistence on a showing of confusion, and we believe that our opinion must be read in that context. Under the circumstances there—involving sales to the consuming public of products bearing trademarks universally associated with Boston Hockey—the fact that the buyers knew the symbols originated with Boston Hockey supported the inescapable inference that many would believe that the product itself originated with or was somehow endorsed by Boston Hockey.”).

Big O Tire Dealers, Inc. v. Goodyear Tire & Rubber Co., 561 F.2d 1365, 1371–72 (10th Cir. 1977) (applying Colorado law). Applying Indiana law, the Seventh Circuit rejected the reverse confusion theory just nine years previously. Westward Coach Mfg. Co. v. Ford Motor Co., 388 F.2d 627, 633–34 (7th Cir. 1968).

See Mutual of Omaha Ins. Co. v. Novak, 836 F.2d 397, 400 (8th Cir. 1987) (“The District Court acknowledged that there may be some ambiguity in the ‘goes along’ question used in the survey, but found the survey as a whole ‘credible evidence of a likelihood of confusion as to source or sponsorship.’” (citation omitted)).

Compare WCVB-TV v. Bos. Athletic Ass’n, 926 F.2d 42, 43–44 (1st Cir. 1991) (affirming district court and denying Boston Athletic Association an injunction against unauthorized use of its Boston Marathon mark on an unauthorized television broadcast of the race), with Bos. Athletic Ass’n. v. Sullivan, 867 F.2d 22, 23–24 (1st Cir. 1987) (reversing district court decision and granting Boston Athletic Association an injunction against unauthorized use of its Boston Marathon mark on t-shirts).

See Bos. Prof’l Hockey Ass’n, 510 F.2d at 1012, cert. denied, 423 U.S. 868 (1975) (recognizing a merchandising right for professional sports teams); Warner Bros., 658 F.2d at 79 (recognizing a similar merchandising right for popular television shows). But see Int’l Order of Job’s Daughters, 633 F.2d at 920 (rejecting merchandising right for a fraternal organization).

See, e.g., Gibson Guitar Corp. v. Paul Reed Smith Guitars, LP, 423 F.3d 539, 550–53 (6th Cir. 2005) (refusing to apply initial interest confusion or post-sale confusion theories to product design trade dress claim over guitar design).

875 F.2d 994, 996 (2d Cir. 1989).

Id.

Id. at 996–97.

Id. at 997.

Id. at 1001 n.8.

Id. at 1000.

Id. at 997–98.

Id. at 998.

Id.

Id. at 999.

Id.

Id. at 1001–02.

New Kids on the Block v. News Am. Publ’g, Inc., 971 F.2d 302, 308 (9th Cir. 1992).

Id. at 304.

Id.

Id. at 308.

Id. at 309.

Id. at 305, 308.

Id. at 308.

Id. at 307.

Id. (first citing Volkswagenwerk Aktiengesellschaft v. Church, 411 F.2d 350 (9th Cir. 1969); then citing WCVB–TV v. Bos. Athletic Ass’n, 926 F.2d 42 (1st Cir. 1991); and then citing Smith v. Chanel, Inc., 402 F.2d 562 (9th Cir. 1968)).

Volkswagenwerk, 411 F.2d at 351–52.

WCVB–TV, 926 F.2d at 44.

Chanel, 402 F.2d at 569 (“We are satisfied, therefore, that both authority and reason require a holding that in the absence of misrepresentation or confusion as to source or sponsorship a seller in promoting his own goods may use the trademark of another to identify the latter’s goods.”).

New Kids on the Block v. News Am. Publ’g, Inc., 971 F.2d 302, 307 (9th Cir. 1992).

Id. at 308.

Id.

Id.

Id. (quoting Prestonettes, Inc. v. Coty, 264 U.S. 359, 368 (1924)).

Prestonettes, 264 U.S. at 368.

See Vogue Co. v. Thompson-Hudson Co., 300 F. 509, 511 (6th Cir. 1924).

Prestonettes, 264 U.S. at 368–69.

See William McGeveran, The Trademark Fair Use Reform Act, 90 B.U. L. Rev. 2267, 2301 (2010).

See id. at 2284.

See id. at 2290–91.

See id.

I understand the argument that Coke and Pepsi are not the same product. See Glynn S. Lunney, Jr., Trademark Monopolies, 48 Emory L.J. 367, 424–25 (1999); see also Mark A. Lemley & Mark P. McKenna, Owning Mark(et)s, 109 Mich. L. Rev. 137, 176 (2010).

Cases in which the consumer knows that he or she is buying a fake are not by this definition “true” counterfeiting. I recognize that courts today routinely label such known fakes as counterfeits. See, e.g., United States v. Hon, 904 F.2d 803, 804–05 (2d Cir. 2012). Because the welfare analysis for sales of lower-priced known fakes is different from the welfare analysis of true counterfeiting, I distinguish the two activities.

I have assumed a linear increase in the chance of success, but that is not necessary for the analysis.

See McGeveran, supra note 105, at 2275–76.

AIPLA, Report of the Economic Survey 2015, at 38 (2015), http://files.ctctcdn.com/e79ee274201/b6ced6c3-d1ee-4ee7-9873-352dbe08d8fd.pdf [http://perma.cc/8UUL-BNE8].

Id. at 39.

See generally Michael J. Freno, Trademark Valuation: Preserving Brand Equity, 97 Trademark Rep. 1055 (2007).

See, e.g., Fishman Transducers, Inc. v. Paul, 684 F.3d 187, 194 (1st Cir. 2012) (“[D]amages awards turn out to be comparatively rare in trademark cases primarily, it appears, because of the difficulty of proving them.”) (citing Freno, supra note 115, at 1062–63). The two exceptions to this general rule are (1) reverse confusion and (2) counterfeiting cases.

Note that the costs of litigation to the two parties need not be the same. I have assumed that the costs are the same to simplify the model.

Depending on the amount in controversy, the 2015 AIPLA survey reported average trademark litigation costs through the end of discovery of $150,000 to $900,000. AIPLA, supra note 113, at 38–39.

It also provides Exxon with a lever to avoid paying potential defendants who adopt interlocking double X marks in an attempt to hold up Exxon.